Perhaps a surprise to most investors, Federal Reserve Chairman Jerome Powell made it clear last month that the central bank will be “resolute” in fighting inflation.

The Fed approved a third consecutive 75-basis-point hike in September, the fifth raise this year, the most aggressive move since the 1980s. The US dollar soared in response.

Those actions dominated the headlines in Q3. Our report examines the performance of gold and other major asset classes in the third quarter of 2022, along with YTD. We also highlight the conditions that could impact the precious metal in the final quarter of the year.

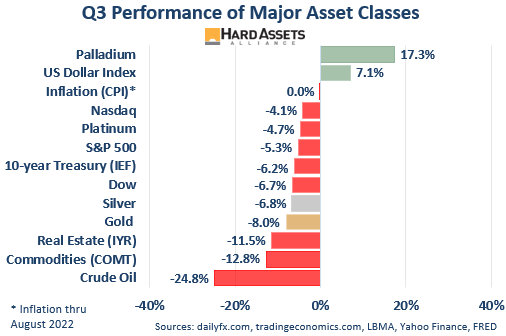

Q3: All Hail the USD

Rate increases and the unrelenting rise in the US dollar wreaked havoc on most asset classes last quarter.

The US dollar rose over 7%, a strong move for a currency in a short period of time. The abrupt ascent pressured stocks, Treasuries, commodities, real estate, and gold and silver.

The obvious exception was palladium, rising 17.3% last quarter, also in striking contrast to its sister platinum.

Inflation showed signs of leveling out. The pullback in crude oil was noteworthy, though perhaps not surprising given the extent of its recent run.

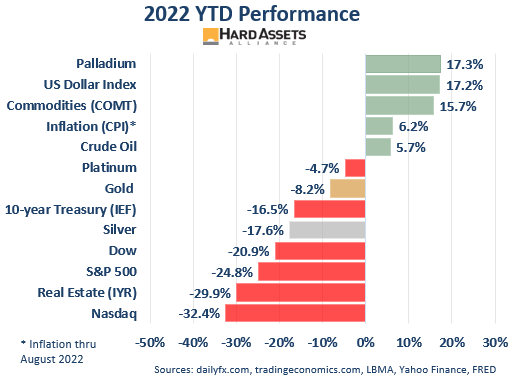

YTD: Gold Softens Stock Losses

Gold is down 8.2% YTD, but that performance is a significant improvement over stocks, Treasuries, and real estate.

Silver is now down over 17% on the year. It’s been gradually falling since hitting $30 in August 2020, with some short-lived rallies along the way, like Monday’s nearly 9% climb.

Palladium leads all comers so far this year, up more than the USD and commodities.

To state the obvious, stocks have not fared well in 2022. The Nasdaq is down by a third, and the S&P 500 has now posted a rare third straight quarterly loss. Crude oil has fallen back to small gain on the year.

What Does Q4 Bring?

It’s hard to imagine a more turbulent environment that could impact the final quarter of the year.

Interest Rate Aggression: The Fed’s benchmark lending rate now sits in the range of 3%-3.25%, the highest level since the global financial crisis in 2008 and the toughest policy move since the 1980s.

Will it get inflation down to the Fed’s 2% goal? A number of economists point out that the elevated CPI is more a result of supply chain issues and less about overheated demand, something higher rates may not necessarily help.

While the debate continues, it should be pointed out that there’s no free lunch with higher interest rates. They’ll likely cause some hardship for both businesses and households, since borrowing costs are significantly higher on homes, cars, and credit cards. Rate hike cycles have also historically led to higher unemployment and lower government revenue, due to reduced personal income and corporate taxes.

When will the Fed pivot? The answer to that question likely signals when many assets, including gold, reverse and turn higher.

Recession Watch: Those that floated the idea that GDP was too strong for the US to experience a recession now seem particularly short-sighted. As one example, the Chicago PMI survey plunged unexpectedly into contraction in September, its lowest level since June 2020. In fact, every underlying component fell from the prior month.

The yield curve (10-year Treasury yield minus 2-year) also turned negative last quarter, an event that has predicted the last 6 recessions.

Meanwhile, both the International Monetary Fund and the World Trade Organization warned that countries around the world are sliding into a global recession. World Bank President David Malpass said developed countries should equally prepare for an economic slowdown. “A series of harsh events and unprecedented macroeconomic policies are threatening to throw development into crisis… This has consequences for all of us due to the interlinked nature of the global economy and civilizations around the world.”

Stock Market Vulnerability: YTD, 2022 has been the worst year for markets in five decades, as both bonds and stocks sold off in unison, leaving those with the traditional 60-40 portfolio nowhere to hide, a fact that highlights the advantage of gold.

According to Bloomberg, a whopping $32 trillion in global stock market value has been lost since November 2021. Many economists state the market remains vulnerable until the Fed reverses course, a fact that is largely true from history.

Real Estate Reversal? The average 30-year fixed-rate mortgage ended Q3 at 6.7%, the highest since mid-2007. For perspective, the 30-year rate one year ago was 3.01%.

Affordability is now the name of the game in housing. With mortgage rate climbing and rents stubbornly high, demand is likely to ease, as it already is in many areas.

European Headwinds: German recently announced a €200 billion ($195B) bailout plan to protect from the fallout of Europe’s energy crisis. Energy prices are 44% higher than a year ago, largely a result of Russia bringing gas exports to a standstill. Combined with a 19% rise in food prices, inflation is now 10%, the highest level since reunification in 1990. In response some ministers have caped gasoline prices.

Protests also erupted in Germany, the Czech Republic and other European countries. Then the NordStream II pipeline was blown up.

Meanwhile, the Bank of England pledged unlimited bond-buying to avert what some view as an imminent gilts crash. Its 30-year yield fell the most on record last month.

Debts and Deficits: Deficit spending in the US continues at near-record levels, with Biden’s student loan forgiveness plan still in the works, passage of which would likely lead to higher taxes and/or more deficit spending.

The US ended the fiscal year with $30.928 trillion in debt, an increase of $2.5 trillion over the prior fiscal year.

The issue with such elevated levels of debt is that higher rates make interest payments an increasingly bigger portion of the fiscal budget.

US Elections: US midterm elections are next month, with the country as polarized as ever. The Stock Trader’s Almanac reported that since 1946, the second year of a new Democratic president has ended with the S&P 500 losing an average of 2.3%.

Crypto Weakness: Bitcoin and other cryptos remain weak, the industry getting far less attention from investors and speculators than it did a year ago. It seems apparent the industry is now largely viewed as a risk-on asset class.

- The need for a safe haven asset is clear. The mix of economic, market, and financial risks leave investors with few places to turn. Gold is an obvious and historically strong choice to balance a portfolio in the current environment.