The American Farm Bureau Federation says the cost for all the ingredients of the traditional Thanksgiving dinner rose 5% this year, now $49.24.

No surprise it’s higher in 2021. But our question here at Hard Assets Alliance is… do gold and silver offset this rise? That’s a fair query, since gold is down 2% on the year and silver -6.1%.

Let’s take a look…

Thanksgiving Dinner Priced in Silver & Gold

In 2001, the American Farm Bureau said the cost of the average Thanksgiving dinner was $35.08. Naturally, those costs, as well as gold and silver prices, have fluctuated over the past two decades.

But what’s the trend? Can we be “thankful” on November 25 that gold and silver have preserved our buying power?

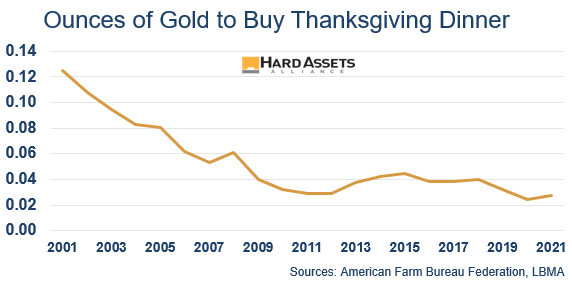

Here’s how many ounces of gold it has taken to buy all the ingredients for the average Turkey day dinner since 2001 (we used the gold price on Nov 1 each year, or the first day of trading that month).

Over the past 20 years, the cost of the average Thanksgiving meal has risen 40.3%. However…

Priced in gold, the cost of turkey day has fallen a whopping 78.4%! From 0.125 ounces to 0.027.

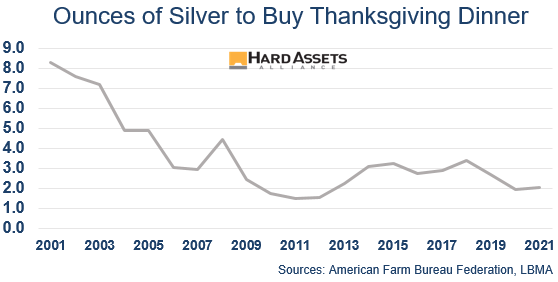

As usual, silver’s ratio to a Thanksgiving meal is even more dramatic.

It took 8.3 ounces of silver to fund your Grandma’s turkey feast in 2001, but now it only takes 2.1 ounces.

In other words, 74.6% less silver is needed to fund the exact same meal today than 20 years ago, even though the price of that meal has risen.

To be fair, the cost rose this year by a tenth of an ounce, as measured by the silver price on the same day every year (November 1). But like many things we buy, silver and gold, over time, have offset that increase in cost.

Let’s be clear about this:

- Not only have silver and gold preserved our buying power, when it comes to Thanksgiving dinner they’ve increased

This is the real value of monetary metals. Since they’re money, it’s what they can buy us that matters at the end of the day.

Not to mention that their next spike could be one for the record books.

So yes, when I take that first bite of turkey, one thing I’ll be thankful for this year is silver and gold.

What’s interesting to consider is the cost of Thanksgiving 10 or 20 years from now. If history is any guide, it’ll be a mountain of gravy more expensive—unless it’s priced in gold and silver.