It’s no surprise to our constituency, but silver remains one of the most undervalued investments that can be bought today.

Regardless of almost any asset class you compare it to, silver offers a better value to investors right now than almost anything else.

A big reason is because it’s one of the few assets still priced below its 1980 high. An asset should obviously appreciate in value over a 41-year period, but even after inflation, the silver price, at current levels, has not.What if it did?

What if the silver price matched the gains other assets have logged since 1980?

This will be fun—but first, let’s get an updated look at how undervalued silver remains…

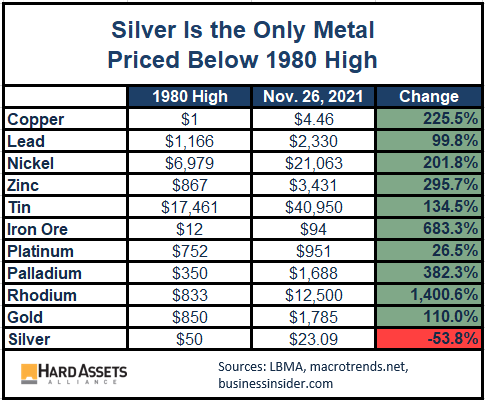

Silver vs. Other Metals

The following tables list each asset’s 1980 high, the current price (as of November 26), and the percent gain or loss over this 41 year period.

Let’s start with the metals. Check out how much each metal has gained from its 1980 high—except silver.

All metals are up double or triple digits (and one quadruple digits). But not silver; it remains 53% below its high of 41 years ago.

We’re just getting started…

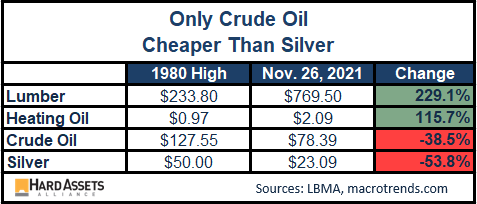

Silver vs. Oil and Lumber

Here’s a comparison of silver to lumber and oil.

Despite its recent pullback, lumber is over three times higher than in 1980. Heating oil has more than doubled. The current crude oil is below its 1980 high, but not as much as silver.

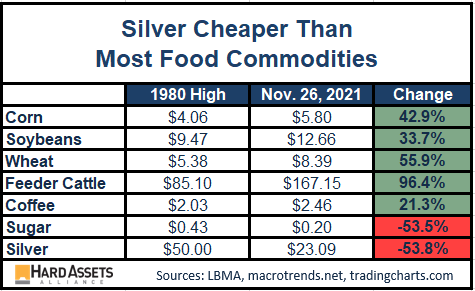

Silver vs. Food Commodities

Here’s silver compared to some of the more common food commodities.

All have risen double digits since their 1980 high, except sugar. It is the only asset I can find that is also currently priced near its 1980 high.

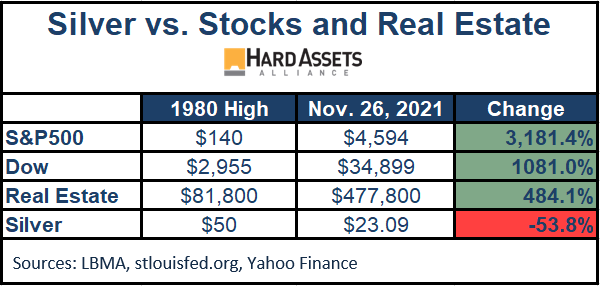

Silver vs. Stocks and Real Estate

Then there’s the stock and real estate markets…

The S&P 500 has risen over 31 times since 1980, the Dow over 10 times, and home prices almost five times. But silver remains 53% below its 1980 high.

If Silver Matched Other Asset Gains

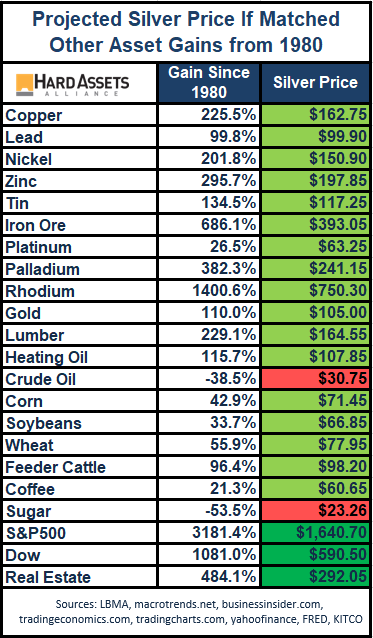

As an analyst I like to ask questions, so when I reviewed the above tables this one popped into my head: what would the silver price be if it matched the gains these other assets have seen since 1980?

Here’s that answer, calculated from silver’s 1980 high of $50…

Silver would clearly be much higher. In fact, in almost two-thirds of the cases, the price would be in triple digits.

The average price would be $250.28.

I bolded the bottom three since they’re the most common investments among mainstream investors. Also because they can be good ratio indicators; the current lopsided value between them and silver right now screams shiny grey metal!

Only a match to the current oil and sugar price would silver end up lower than $50.

There Are Two Messages to All This…

It may be frustrating to watch other assets climb in price while silver remains weak. But there are two realities staring us in the face:

- Silver is the most undervalued asset an investor can buy right now. That won’t last indefinitely.

- Silver is a monetary metal, and given the precarious nature of the monetary system, the importance of holding it—and its upside potential—is enormous.

Based on this historical overview, and the likely path ahead, I think some of the biggest gains over the next few years will come from silver.

One thing seems clear: buying silver now is a bargain.