The Next Great Silver Rush: Powerful Forces Converge to Push Prices Upward

In this report: the powerful trends converging that could send silver surging in 2023.

Demand for silver is soaring in 2023. Almost every modern device on the planet needs silver to operate from Teslas to iPhones. Meanwhile there is less silver available.

Make sure you’re positioned to potentially profit from the coming silver bullet by investing in physical silver today.

It’s easy to do with Hard Assets Alliance. You can buy, hold, and sell physical silver 24/7 – in a few taps on your phone.

THE SAME PLATFORM TRUSTED BY OVER 100,000 INVESTORS AND COUNTING

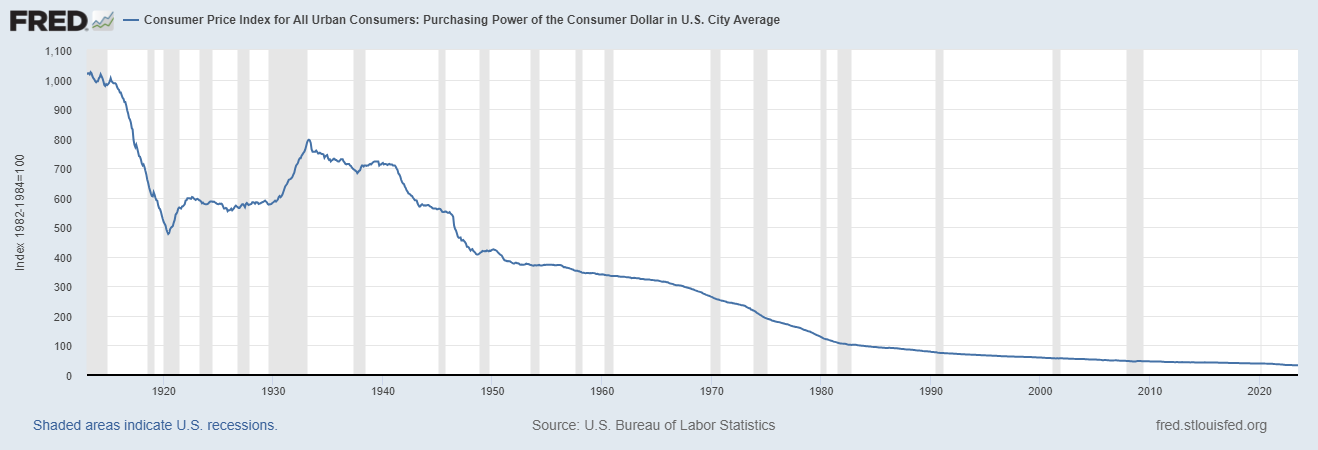

Protect Your Wealth from the Devaluation of the Dollar with Silver

In July 2023, Moody’s Analytics reported that the average American household spent an extra $709 compared to two years ago for the same items.

This spike is largely due to rising housing costs, but also includes higher expenses on groceries, vehicles, and services like cable.

But the truth is that this decline is nothing new. Every year the purchasing power of the dollar is falling.

Our current trajectory of deficit spending and unchecked money printing is a recipe for disaster.

Did you know it took the U.S. 209 years to accumulate its first $1.8 trillion in debt?

But we just added $1.8 trillion in debt in a mere 8 weeks after the historic June 2023 debt ceiling deal. We’re now spending in weeks what once took us centuries.

And the world is starting to take notice…

The World is Pivoting: BRICS Countries Lead the Charge Away from the Dollar

Amid escalating geopolitical tensions, the BRICS nations – Brazil, Russia, India, China, and South Africa – are poised to challenge the long-standing dominance of the U.S. dollar. In the summer of 2023, the BRICS countries announced plans to introduce a new gold-backed trading currency.

Their primary goal is to disrupt the U.S. dollar’s supremacy and the Swift international payment system. Notably, they are not alone in this pursuit. Over 30 countries have shown interest in joining the BRICS alliance, with the founding members set to review and approve new members in August 2023.

The notion of ‘de-dollarization’ was once considered far-fetched. Now, however, a gradual shift away from the U.S. Dollar – or at least the emergence of a viable alternative – seems not just plausible, but inevitable.

Right now, we have a current global economic backdrop where the Dollar is facing legitimate challenges as the global reserve currency for the very first time.

As this uncertainty continues, more people will turn to precious metals like gold and silver. That’s what people have done for thousands of years.

Why Silver Belongs In Your Portfolio

Gold and silver have no counterparty risk. In fact, if you own physical gold or silver, there is no other party involved. No counterparty means there is no counterparty risk. Precious metals don’t depend on any people or institutions to give them value, unlike paper currencies.

While gold has always been known as the ultimate safe haven, there’s mounting evidence that silver could be the star performer in the coming years.

Silver offers the same security as gold does… It’s a hard asset, scarce in supply, that’s been a trusted store of value since the dawn of civilization. In fact, silver is so synonymous with money, the word silver means money in dozens of languages around the world. “Argent” in French being a notable example.

But in addition to being money, silver also has huge industrial demand that affects its pricing and availability.

Silver Shortage Alert:

Why Now is the Time to Invest

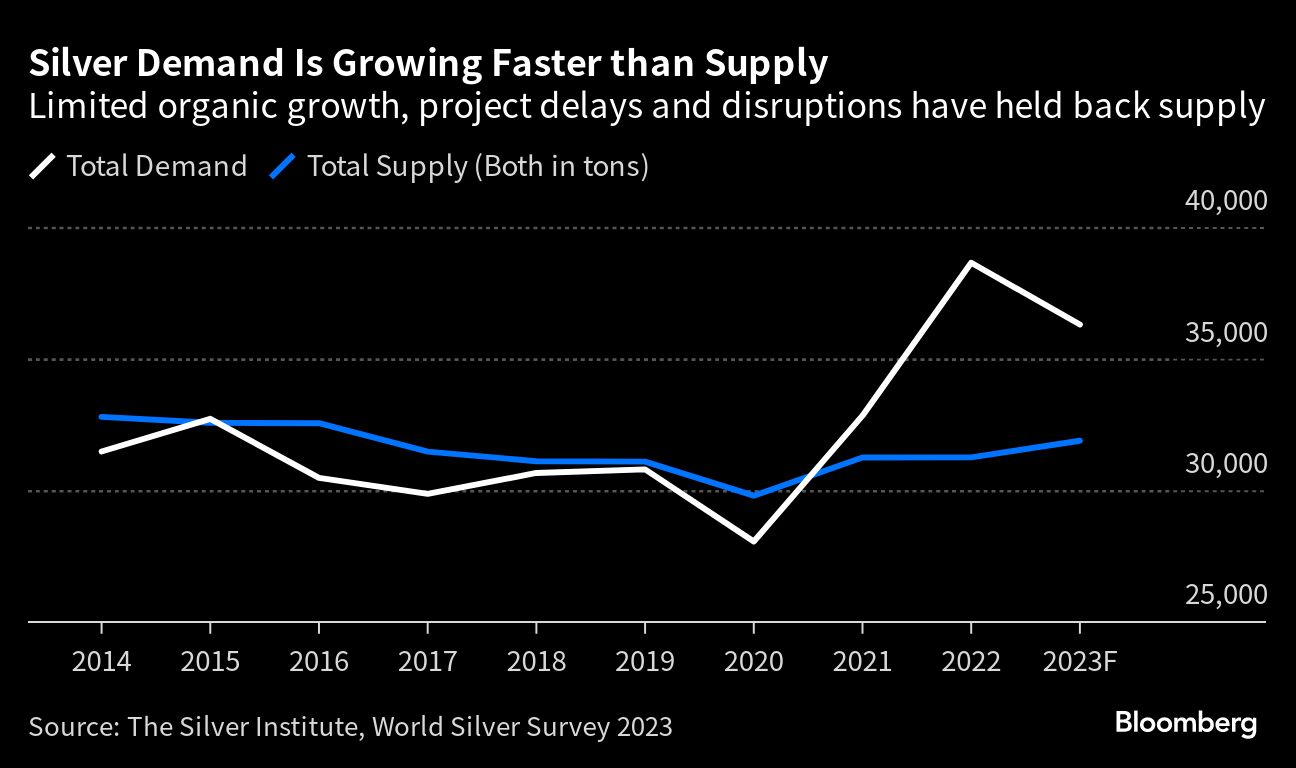

The World Silver Survey 2023 by the Silver Institute unveils a trend that’s hard to ignore: the silver market has been grappling with a deficit for two straight years. In 2022 alone, the market was short by a significant 237.7 million ounces, and 2023 is expected to follow suit with a projected deficit of 142.1 million ounces.

Several factors contribute to this tightening supply. The mining industry, for one, is facing rising costs, both in energy and labor. Silver mining has become less profitable because costs are continuing to rise, while the price of silver has remained stagnant. This is made worse by new stringent environmental regulations, which are adding several new layers of complexity and cost to the mining process.

Adding to this supply strain is a significant decision from Mexico. Historically one of the world’s largest producers of silver, Mexico has instituted a ban on open-pit silver mining, one of the cheapest forms of mining. This just puts up another hurdle for silver miners in the area.

Right now, the silver supply simply isn’t keeping up with demand.

Skyrocketing Demand Meets Dwindling Supply

Believe it or not, you don’t go one day without using a product that contains silver. It’s used in nearly every major industry, used extensively in electronics, from everyday devices like smartphones and laptops to sophisticated medical equipment.

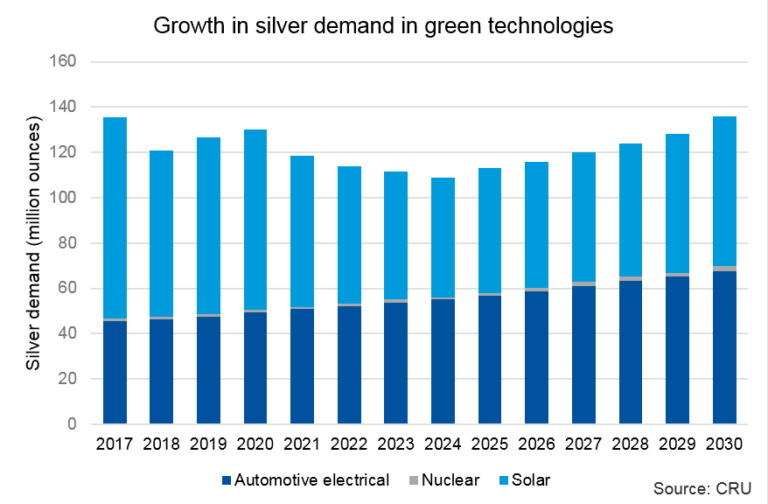

Silver is everywhere, whether you see it or not. And over the next decade, global silver demand is poised to soar even higher, driven by new emerging technologies like electric vehicles, wind energy, and solar power.

New changes to solar panel technology are accelerating demand for silver. This latest wave of new solar technology uses substantially more silver than previous cells – a vital component of solar tech – which could trigger a surge in demand in an already bustling market.

In fact, the Silver Institute forecasts over 1.5 billion ounces of silver will be consumed in green technologies through 2030.

Silver demand from solar alone has grown from less than 50 million ounces (Moz) a decade ago to an expected 160 Moz in 2023.

The average electric vehicle battery uses between 25-50g of silver per vehicle — almost twice the average of an internal combustion engine.

Silver is crucial for photovoltaic (PV) power, especially in solar cells, which are now the leading source of green electricity.

New changes to solar panel technology are accelerating demand for silver. This latest wave of new solar technology uses substantially more silver than previous cells – a vital component of solar tech – which could trigger a surge in demand in an already bustling market.

In fact, the Silver Institute forecasts over 1.5 billion ounces of silver will be consumed in green technologies through 2030.

But that’s not the whole story… unlike gold, as much as 30% of silver used by industry is destroyed during the fabrication process or the product is simply thrown out after use. It’s just not economical to recover every tiny flake or sliver of paste from millions of discarded products like cell phones and batteries. As a result, that silver is gone for good, further limiting the amount of supply that can return to the market through recycling.

Considering the decline in silver mining operations coupled with the emerging need for silver across numerous industries, experts are warning of an impending silver shortage.

With mining operations slowing and demand surging, this puts big pressure on the silver price to increase to make it more economical to mine.

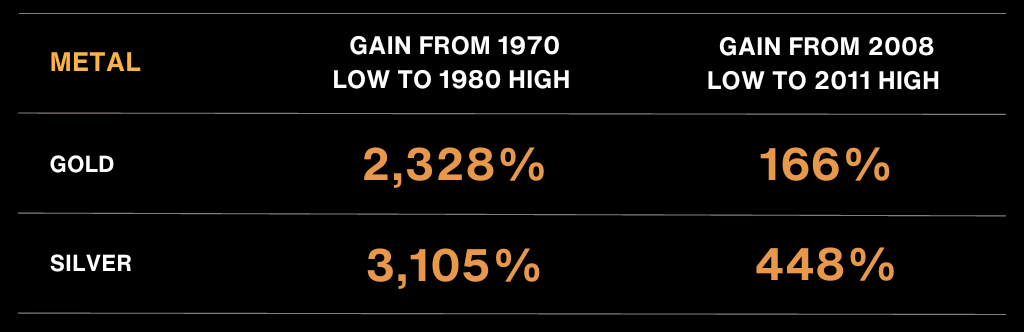

Silver Outperforms Gold In Bull Markets

During precious metal bull markets, silver typically soars much further and faster than gold.

Check out how much more silver gained than gold in the two biggest precious metals bull markets in the modern era:

This greater volatility means that in bear markets, silver falls more than gold. But in bull markets, silver will soar much further and faster than gold. We can expect this outperformance to repeat in the next silver bull market, too, because the silver industry remains tiny.

Because silver is much more affordable for the average investor, the crowd of people piling into silver during bull markets can be exceptionally large.

If you can’t afford to buy a full ounce of gold, silver can be your ticket to holding some precious metals.

And right now, silver is at an incredibly low price based on history.

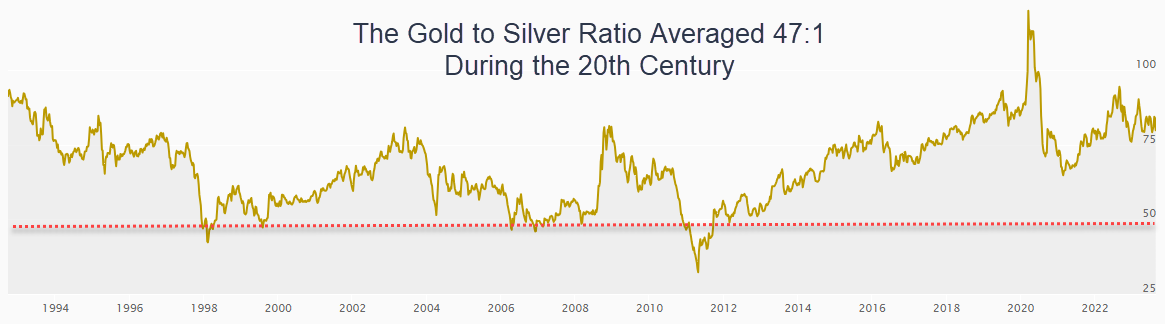

The Gold/Silver Ratio Favors Silver

If you’ve ever heard of the gold/silver ratio (the price of gold divided by the price of silver), you’ll know that it can give clues about which metal might be the better buy at any given time. Especially when the ratio reaches an extreme…

During the 20th century, the gold/silver ratio averaged 47:1.

Since 1968, the gold/silver ratio moved slightly higher to 56:1.

Today the gold/silver ratio is closer to 84:1.

When the ratio has topped 80, it has signaled a time when silver was relatively inexpensive relative to gold. Silver went on to rally 40%, 300%, and 400% the last three times this happened.

It all adds up to silver potentially being the buying opportunity of the decade.

Ready to Get Started?

*By submitting this form, you agree to receive email from the Hard Assets Alliance. Unsubscribe anytime. Disclaimer & Terms of Use

With what you’ve read so far, you know way more than most investors about the silver market.

Silver could be the most ignored and undervalued commodity in the world right now.

After all, silver has a 5,000-year track record of storing value. And unlike paper assets, it can’t be made out of thin air.

If you hold physical silver, you don’t need another party to make good on a contract or promise. This is not the case with stocks or bonds or virtually any other investment. Silver has never been defaulted on. If you own physical silver, you have no default risk. Not so for almost any other investment you make.

That’s why the world’s wealthiest investors are expecting silver to go higher in 2024…

How high could silver go?

• Analysts at Citi (formerly Citigroup), say silver could reach $30 per ounce in 2024.

• John La Forge, head of real asset strategy for Wells Fargo, believes silver is in a super cycle. He has a silver price target of $48 per ounce within the next five years.

• And Robert Kiyosaki, author of the financial classic, Rich Dad, Poor Dad, is very bullish on silver stating he thinks we’ll see silver reach $75 per ounce in 2024…

It’s tough to say for sure, but as you can see, many smart investors are betting on silver prices going higher.

And if you want to get in before silver makes its next big move Hard Assets Alliance may be the ideal place for you.

HARD ASSETS ALLIANCE

Your New Standard in Silver

The Best of Both Worlds: True Ownership and Digital Access

With our easy-to-use online marketplace, you can buy, sell and trade real, physical silver with ease. And getting started is simple.

Open an account in minutes. Fund. And start investing, 24/7. Add to or sell some of your holdings any time, in a matter of seconds.

Hard Assets Alliance was started by investing professionals who saw the potential in gold and silver, but also the shortcomings of the precious metals industry – like how investing in precious metals should be as easy and secure as trading stocks and bonds.

We imagined a better, more transparent silver buying experience, then built it from the ground up – with total digital access and true ownership.

This is 100% real, physical metal.

Stored on your behalf in the world’s most secure, third party vaults. Or delivered globally. All at your fingertips.

Over the past decade we’ve helped investors just like you protect and grow their wealth with silver.

Whether you’re looking to better secure your retirement…

Diversify your portfolio…

Reduce volatility…

Or ensure a legacy for your family for generations…

Hard Assets Alliance has solutions tailored to every stage in your investment journey.

So get the protection and peace of mind that gold can give you.

Open an account today and see what makes us the new standard in silver.

*By submitting this form, you agree to receive email from the Hard Assets Alliance. Unsubscribe anytime. Disclaimer & Terms of Use

Put the Power of Silver in Your Portfolio

Nearly $2 billion of our customers’ most precious assets under management

Open an account with Hard Assets Alliance and you’ll get access to:

Easy, powerful platform trusted by many of the world’s largest wealth managers

US and overseas vault options

Competitive online marketplace where wholesalers bid on every order

Secure non-bank owned vaults including Brinks, Loomis, and Malca-Amit

London Bullion Market Association-approved dealers

And these investor-friendly benefits:

Own whole fully-allocated bars and coins

No paper promises or small shares of giant bars you can never claim

Full replacement insurance on your stored gold, silver, platinum and palladium

No counterparty risk: You own the specific coins or bars you purchase

Unbroken chain of custody: Your bullion is documented and tracked

Regular audits by independent security firms

Around-the-clock surveillance with armed security personnel

State-of-the-art electronic protection of your assets and data

Some of the lowest fees in the market

Plus, flexible options for investing on your terms:

All metals are liquid – sell online in a matter of seconds

“Set and forget” automatic investing for dollar-cost averaging over time

Request physical home delivery of your metal at any time

Enjoy tax-advantaged investing with retirement account options

Give the gift of gold with ease with legacy accounts including trusts

Hold precious metals as a first-class company asset for your business

Hard Assets Alliance gives all investors, regardless of portfolio size or net worth, access to an institutional-class platform for buying and selling precious metals without needing to go through the hassles (or worry) of home storage.

Sign on, click, and manage your physical bullion assets holdings just like you would a stock brokerage account. It’s that easy.

Ready to put the power of gold to work for you?