The Three Most Common Gold IRA Traps and How to Avoid Them

Table of Contents

History has proven gold as one of the most stable and consistent investments available, helping to protect portfolios from wild market swings or prolonged periods of economic instability.

That’s why so many experts advise holding 5-7% of your wealth in assets like gold to ease the effects of volatility and improve your portfolio returns.

But to make the most out of your gold investment, it’s important to do plenty of research on the company you do business with, and what kind of account you choose. It could end up saving you thousands in the long run.

Why Hold Gold in an IRA?

Hands down, the best way to invest in gold is through an IRA. Investors receive an extraordinary tax break for doing so, far greater than investing in stocks or bonds.

A quick example: If you invested $100,000 in gold bars, and just for easy math, let’s say you made 10% annually over the next 30 years. Your $100K initial investment would have grown to over $1.7 million.

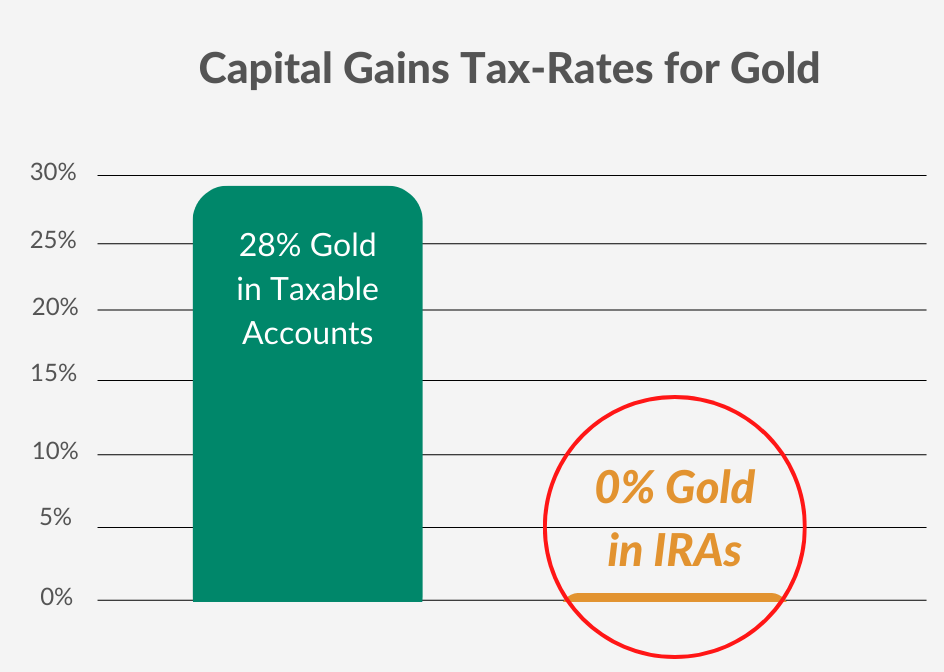

Now, if you bought these gold bars in a standard, taxable account you would be on the hook for a big tax bill. You would owe nearly a third of your profits in taxes. The reason? Unlike stocks or bonds, where a sliding scale capital gains tax applies, the IRS taxes gold like a collectible at 28%.

In this scenario, $1.7 million taxed at 28% comes out to $488,000 in taxes!

But if you invested in those same gold bars using a tax-exempt IRA, assuming you’re eligible, you can sell them anytime, and enjoy the proceeds, tax-free.

Or you can buy gold in a “traditional” tax-deferred IRA, enjoy deductions on your return today and reduce your tax liability down the line.

The choice is yours. The point is, you get the flexibility and liquidity of a brokerage account with your choice of tax benefits for holding what many people view as the ultimate safe haven asset: physical precious metals.

And that’s why Gold IRAs are so popular.

They’re helping millions of investors put the power of gold to work for them.

Unfortunately, where there’s lots of investor demand, there are lots of companies looking to take advantage.

The good news is, spotting these nefarious companies is very easy once you know what to look for…

Read on to become an expert in spotting Gold IRA traps. It will only take you a couple minutes and it could just save you your life savings.

It’s never been easier to invest in precious metals

Trap #1

All Gold is NOT Created Equal

When investing in gold, it’s important to make sure you’re buying the right type. There’s two types of gold you can invest in…

- Bullion

- Collectible (sometimes called “numismatic” gold)

Beware: both of these have the same purity. The same gold content. But how they are priced is vastly different. And as investors who want to get the most amount of ounces for your currency, we need to know the differences.

The Gold in Fort Knox vs. Fool’s Gold

The price you pay for gold is made up of two components: the spot price and the manufactured price.

The spot price of gold – or any commodity for that matter – represents the price at which the commodity trades on the market. The gold spot price is computed using data from the futures contracts traded on the COMEX, which tracks gold exchanges all over the world.

But you can’t simply buy gold at the spot price. To own physical metal, you must buy a refined product that takes great effort to extract from the Earth and refine and get to market. That additional cost to shape the gold into investable units–bars and coins– is the manufactured price, which is also known as the premium.

To get the most bang for your buck, you should always try to buy gold with lowest premiums, in other words, the total price is as close to the spot price as possible. The best way to do that is to buy bullion.

Bullion is mass-produced gold bars or coins made by recognized mints in a standardized process. Bullion is recognized all over the world as a good gold investment.

The gold inside Fort Knox? That’s bullion.

Those big gold bars you see in the movies? Bullion.

Gold held by hedge funds and banks? Bullion.

Billions of physical bullion trades hands each day. It’s one of the largest markets in the world. Because it’s manufactured in bulk, bullion has very low premiums. Typically you’ll only pay a small percentage over the spot price to own bullion .

But here’s the catch… not every company that deals in gold IRAs sells bullion.

They push people into collectible gold or as it’s sometimes called “numismatic” or “graded” gold. As the name suggests, collectible gold has high premiums over the spot price.

How high? It’s shocking. Collectible gold sells for 40-50% above the spot price.

And those who sell collectible gold in IRAs will tell you the premium is justified. They’ll say the gold is rare, or it’s a limited edition, or it carries a “commemorative” design…

It’s all part of the sales pitch to convince unsuspecting investors to pay big markups they don’t have to pay.

Unfortunately, it’s all too common to see people get fleeced…

$300,000 Gone Forever

According to a lawsuit brought by the Commodity Futures Trading Commission (CFTC), Metals.com and its parent company TMTE defrauded at least 1,600 investors out of $185 million.

Metals.com’s team of over 100 salespeople would push seniors to convert their retirement account to supposedly “collectible coins” – but the value of the coins was actually much lower than they were advertising. Because of the high markups, investors were immediately deep in the red, needing a massive move higher in gold just to break even.

In one instance, one of Metals.com’s customers lost more than $300,000 of his retirement savings while making what he was led to believe was a safe investment in silver coins.

And the Metals.com episode wasn’t an isolated incident…

“Targeting the Elderly and Inexperienced”

According to court documents, Chase Metal, Barrick Capital, and others were doing it too. They’d lie to potential customers, grossly inflating the true value of the metals they were selling. In some cases, they’d charge hidden commissions to customers, instantly reducing their assets’ value by as much as 33%.

For years, these firms defrauded thousands of elderly investors. Some estimates suggest they defrauded seniors out of as much as $185 million, but it’s tough to know for certain.

It wasn’t until 2020, just a few years ago, that Attorney General Ken Paxton and the Texas State Securities Board joined the Commodity Futures Trading Commission and 29 other states to put a stop to them.

“I will not stand by as these companies use deceptive tactics and underhanded attempts to siphon cash from Texans who seek only to wisely invest their hard-earned retirement savings. The abuse of hardworking Texans, particularly senior citizens who look forward to a secure retirement, cannot be allowed to continue,” – Attorney General Paxton

Many of these firms have paid fines or were shut down… But, unfortunately many senior citizens who invested early on were out of luck and their lives were never the same.

What to Look for…

With something as important as your retirement savings, there’s never any need to rush a big decision.

Always make sure you do a little comparison shopping to ensure the price you’re paying for gold is at a competitive level. You want to make sure you’re always purchasing bullion, not any type of collectible coins. And ideally, you want to buy it as close to the spot price as possible.

It’s important to take your time to do proper research on the firms you do business with. You might be surprised what pops up when you Google them.

Trap #2

Vault Risk Means You Could Lose Everything

Since IRAs tend to be a big portion of most people’s entire net worth, you want to ensure its security. That’s why using outside storage options over holding it yourself makes sense.

But like not all gold is created equal… not all storage is created equal either.

When investing in a gold IRA, find out where the gold is being kept, who watches over it, and how the ownership is determined.

In short, you want…

- Separate chain of custody

- 100% allocation to you, held in your name, you own it outright

- A reputable vault with armed guards, insurance, and independent auditing.

Now, this may sound obvious, but it’s worth stating because there’s plenty of examples of folks who have been burned by gold IRA companies with unscrupulous (even non-existent!) vaults.

Which led to them not having rights to the gold… it wasn’t held in their name… but it wasn’t even there at all!

The Madoff of Gold IRAs

In 2016, Northwest Territorial Mint (NTM) unexpectedly filed for bankruptcy after reports surfaced that many customers never received delivery of their precious metals orders.

Total losses were as high as $50 million and the U.S. Trustee in charge said, “based on our analysis to date, the bullion sale of operations have attributes of a Ponzi scheme.”

Reports later came out estimating the recovery for unsecured creditors were less than 10%… and unfortunately, Northwest Territorial Mint’s customers bore the brunt of those losses.

Defrauding Customers and Money Laundering

Gold investors who did business with Bullion Direct had a similar experience. Bullion Direct’s owner was convicted by the U.S. Attorney in Texas for money laundering and scheming to defraud customers out of millions of dollars.

Turns out, instead of buying precious metals with customer’s funds and storing customer metals, he was living it up, spending that cash on company expenses and himself.

A federal jury convicted him of two counts of wire fraud and one count of engaging in a monetary transaction with criminally derived property.

What to Look for…

Look for companies who use an independent third-party custodian, who is not connected to any of the dealers with whom it does business. Whoever your custodian is, they should have their depositories verified regularly by independent auditors.

These types of firms deal with highly respected, well-established vaulting firms – like Brinks – and their auditing systems and security are second to none.

Your precious metals should be held in “bailment,” which is a legal term meaning you receive warehouse receipts certifying that the assets in question belong to you, and you alone. Not the storage facility, and not the IRA firm itself.

Bailment is iron-clad ownership. No matter what happens – even in the unlikely event the IRA firm goes bankrupt – your precious metals are still yours because they’re in your name. Your assets are still safe and secure. And they are fully-insured for replacement value in the unlikely event anything happens to them.

Trap #3

High Pressure Salespeople

Maybe you’ve seen the popular hit movie The Wolf of Wall Street starring Leonardo DiCaprio. It became a hit instantly by exposing the crazy lifestyle of corrupt Wall Street stockbrokers, focusing on the fascinating story of legendary con-man, Jordan Belfort.

Belfort was a former hot-shot stockbroker who loses his job on Black Monday and is forced to take a job at a boiler room brokerage firm selling penny stocks. He makes a name for himself, and a small fortune along the way, thanks to his highly aggressive and misleading pitching style and the absurdly high 50% commissions the company charges.

Belfort was famous for saying anything to get the sale, whether that was stretching the truth, outright lying, or even fraud – and it eventually caught up with him and sent him to prison.

And with a lot of people looking to protect themselves and open Gold IRAs these days, there are companies using Belfort’s playbook with high-pressure sales tactics and high commissions to help themselves get rich quick at the expense of everyday investors.

But like Belfort, they’ve been caught (and will be caught again)…

The Bait and Switch

According to a Santa Monica lawsuit, Seacoast Coin — formally Merit Gold and Silver — was allegedly guilty of “tricking consumers into buying overpriced gold and silver coins and through misleading sales tactics.”

They would trick unsuspecting customers who were advertised gold bullion on TV at 1% over cost… but then once they had them on the phone would “bait and switch” them into buying non-bullion coins at 40% over cost.

Many of the customers that ended up using their IRA program were recommended Merit’s overpriced “proof” gold coins. Investors who bought these overpriced collectibles saw the value of their gold IRAs drop 25% or more overnight.

Another tactic Merit allegedly used to switch consumers away from bullion was claiming that non-bullion coins could not be “confiscated” by the government, while bullion could be. This is a common claim in the gold coin industry. The truth is that the government cannot confiscate any kind of gold under current law.

Merit Gold knowingly deceived their customers to make an extra buck. And unfortunately, they weren’t the only ones…

High Pressure to Trade on Margin

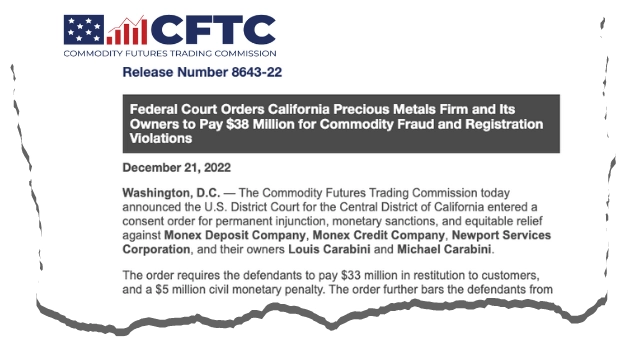

According to a recent complaint from the Commodity Futures Trading Commission (CFTC), a gold company named Monex has defrauded thousands of customers out of millions of dollars, while executing thousands of illegal, off-exchange leveraged transactions.

They allowed customers to purchase precious metals on high margin, where they paid only a small portion up front and the remainder was financed by Monex.

And the whole time aggressive salespeople pressured clients to invest more and more while downplaying the true dangers of trading on margin.

As a result, a small dip in the price of gold caused many customers to owe considerably more than they originally deposited. The complaint from the CFTC says that “many elderly Americans lost their life savings.”

What to Look for…

Now most folks in sales aren’t the Jordan Belfort type. But when incentive drives compensation, you’re bound to get some who push the boundaries.

And think about it – where would Gold IRA companies get the money to pay high commissions? They are getting it from you – either by outright fraud, extremely high markups on gold, or some other under-handed tactic yet to be discovered.

Given the weight of any major retirement decision, it’s important to educate yourself independently, take your time, and not rely on any one person’s sales pitch.

Don’t get pushed around. Because once you buy from a salesperson like Belfort, you’re trapped. There’s no returns, no refunds, and no “cooling period” in the bullion industry.

So, take your time finding a company that you trust.

Avoiding These Traps is Crucial To Your Success

To set the record straight, holding gold in your IRA is the best way to invest in precious metals for most people.

Many of the dishonest gold IRA companies have gone out of business or been caught. And today there’s over $30 billion in legitimate Gold IRA accounts nationwide.

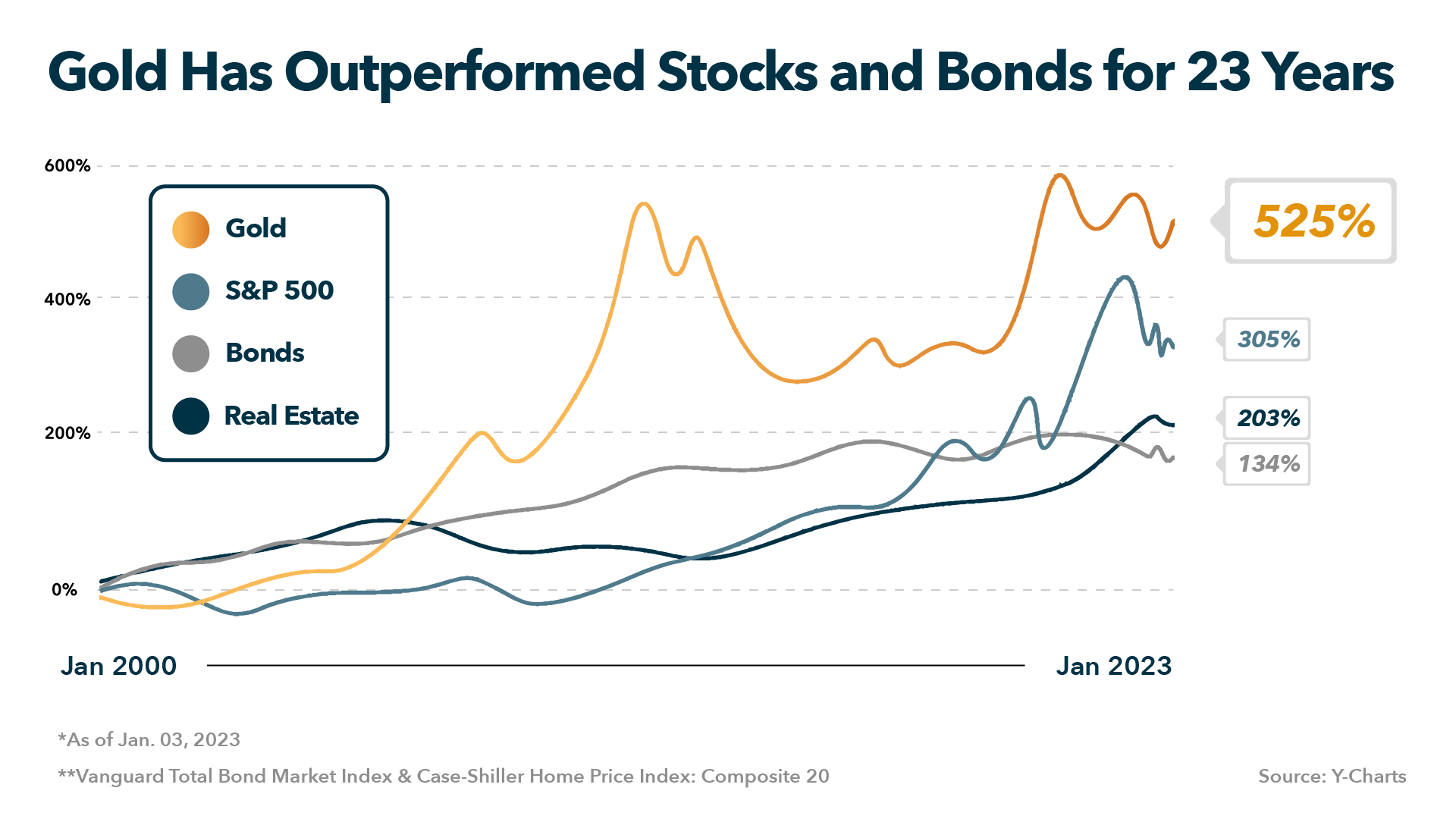

That number continues to grow as many folks are beginning to realize gold isn’t merely a hedge. It’s the best performing major asset class of this century, outperforming stocks, bonds, and real estate through ups and downs.

Investors who own gold often earn much higher overall returns than those who don’t.

And when you’re investing in gold, you get some major tax benefits when you hold that gold in an IRA. Let’s review them quickly…

Tax-deferred accounts, like a 401k or traditional IRA, allow you to delay paying taxes until you retire and take a tax deduction on any contributions you make during the current tax year.

But there’s also Roth IRA tax-exempt accounts, if you’re eligible, which give you the option to make withdrawals 100% tax-free when you retire.

The only catch with tax-exempt accounts is that unlike a traditional IRA or 401k, the money you put in your Roth today isn’t deductible on yearly filings, but it’s a worthy tradeoff.

If you believe that gold and silver are going higher over time, then a Roth IRA account makes a lot of sense to shield your gains from taxes in the future.

This is especially true for gold, since the tax rate is higher than for other investment assets, currently taxed at a maximum rate of 28% in the US with no special “long term capital gains” treatment (because the IRS taxes gold like a collectible).

But the great thing about an IRA is the freedom to change your strategy. If gold takes off and stocks look cheap, you can sell your gold and take some profits without the tax hit.

You get maximum flexibility.

Ensuring you make the most of your tax advantaged options and avoiding these common traps could be the biggest factor in how well your precious metals portfolio performs in the long run.

Now that you know how to identify some of the most common traps, you should be much better prepared to get started.

But with major financial decisions, even after extensive research, it can be extremely helpful to speak with someone you can trust who is knowledgeable in the field.

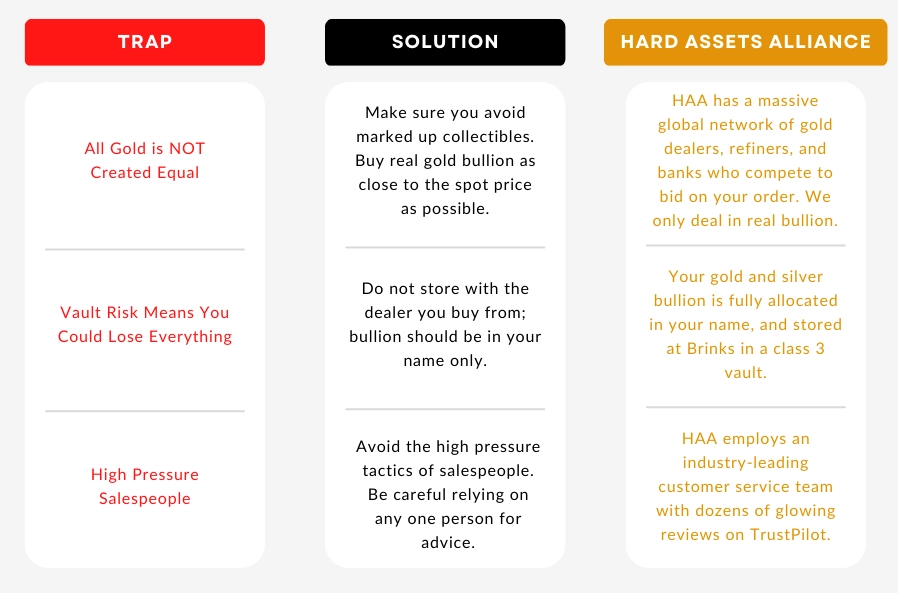

The Company You Partner With Matters

Who you purchase your gold from, and who you open an account with, matters. Luckily, you can avoid many potential problems simply by working with the most reputable bullion dealers and storage facilities.

At Hard Assets Alliance, that’s exactly what we aim to provide.

Hard Assets Alliance is built on the secure platform used by the world’s largest wealth managers, giving individual investors institutional-grade access to physical precious metals markets.

It’s your gold, truly allocated in your name. Every order you place is bid out to our trusted network of global mints, refiners and wholesalers, providing you with highly-competitive pricing when you buy and sell.

You can add to or sell some of your holdings any time. All online in a matter of seconds.

We partner with the top names in vault security like Brinks, Loomis, and Malca Amit. That way you have the option to store your precious metals in our world class vaults in the U.S. or overseas.

However, you can always take delivery of your metals at any time. Simply log in and request delivery and we’ll ship them to you.

Hard Assets Alliance has become one of the most trusted names in the gold industry on a platform that’s trusted by over 100,000 with $3+ billion in assets and billions more delivered.

Our consistently low prices, top of the line storage options, and 5-star professional, no-pressure service give our customers something to feel good about.

The difference between Hard Assets Alliance and the competition is night and day.

At Hard Assets Alliance, we aim to make buying gold as easy as buying or selling a stock. You can sell your gold and take profits, average down when prices are low, or withdraw proceeds in retirement. You have ultimate liquidity and flexibility and it’s at your fingertips via our mobile, app, or desktop login, or you can give us a call.

No red tape or long-term commitments.

Plus, our team works with you to find a solution to your needs – whether that’s funding your gold IRA by transferring cash from an existing IRA, rolling over a work retirement plan (like a 401k), or help making an annual contribution.

That’s why our team at Hard Asset Alliance is routinely rated as one of the best in the industry – with dozens of rave reviews and an average score of 4.7 stars on review website TrustPilot.

“Sam was outstanding! I didn’t feel rushed, pushed, nudged in any way. As a newbie, she attended to my how-to questions providing me with informative and useful answers.”

Stephen

“Kelly always gives me personalized service so it feels like they know me and they are wonderful at guiding me as I am new to investing in metals. Such a VIP experience compared to the large investment houses…great company if you are interested in metals.”

Michael D.

“Jenelle was very patient and helpful helping me sort out an anomaly on my attached ACH bank account.”

Bill F.

“Customer Service is outstanding. They answer questions thoroughly and quickly. It’s a good feeling for someone like me who is new to investing like this.”

Carlos

A quick look at the reviews and you’ll see our company stands out as a positive light in compared to the shady gold IRA companies we mentioned earlier, many of which are actively looking to milk investors… a few may even be calling you today, trying to get your business.

Hard Assets Alliance is trusted with over $3 billion of 100,000 customers’ most precious assets, including many of the world’s largest wealth managers.

If you have any questions about opening a gold IRA, Hard Assets Alliance has a dedicated client service team who can answer any questions you have and walk you through the entire process.

Our representatives are non-commissioned so they have no incentive to pressure anyone into anything – they’re simply here to answer questions. And many have built up fantastic relationships with our clients over the years.

If you’re ready, you can open a no-obligation gold IRA account today and log into the Hard Assets Alliance platform, check our pricing, test drive it out without any commitments or actions required.

Note: This is not tax advice. Content on this page regarding taxes is for informational purposes only. Hard Assets Alliance cannot answer individual tax questions; we recommend that you contact a tax professional.

Open a Gold IRA in 5 Minutes

- Invest in physical gold or silver for retirement

- Ability to enjoy tax benefits including income deductions and tax-deferred or tax-free distributions

- Easily rollover from a 401k, or transfer from an existing IRA

- With help from our expert custodian partners at Equity Trust available every step of the way

- Get more hedge for your dollar invested by combining gold with an IRA

We have three easy options to get started:

Enter your email address to get started

Schedule a meeting with one of our representatives over the phone

Call, Email, or Chat with Us

877-727-7387

[email protected]

Or click the Chat Bubble to chat with a representative