If politicians in Washington can’t reach an agreement, the U.S. government could start to run out of money within weeks.

The debt ceiling, a law that sets a limit on the total amount the government can borrow to pay its bills, currently stands at around $31.4tn. This limit was exceeded in January, with the Treasury Department taking ‘extraordinary measures’ to sustain government operations.

However, Treasury Secretary Janet Yellen warns that without more borrowing, the U.S. will not be able to meet its financial obligations by 1 June.

If no agreement is reached to raise the debt ceiling, the results could be disastrous for millions of Americans.

Federal and military employees might not be paid, Social Security checks could stop, and the government could default on its debt. Moody’s Analytics suggests that a prolonged standoff could cause stock prices to drop by nearly 20%, contract the economy by over 4%, and lead to the loss of over seven million jobs.

An economic slowdown would be bad for most Americans, but it could be a boost to the price of precious metals.

If you are looking for evidence of that, just look at what many of the world’s governments are currently doing…

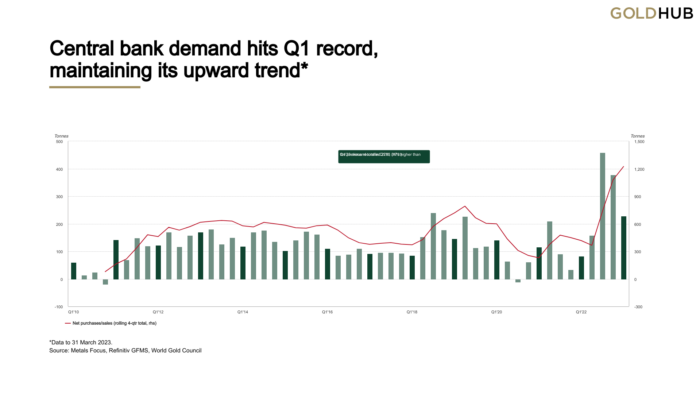

Central Bank Gold Demand Hits First-quarter Record

According to reports from World Gold Council, central banks are purchasing gold at the highest rate since 2000.

In total, they added 228 tons of gold to global reserves in the first quarter of 2023. The Monetary Authority of Singapore led the buying spree, adding 69 tons, a 45% increase from the end of 2022.

“This marked a banner year for central bank buying: 2022 was not only the thirteenth consecutive year of net purchases, but also the second highest level of annual demand on record back to 1950, boosted by +400t demand in both Q3 and Q4… It’s hardly surprising then that in a year scarred by geopolitical uncertainty and rampant inflation, central banks opted to continue adding gold to their coffers and at an accelerated pace.” – World Gold Council

Notably, investment demand spiked in March following a series of failures in the U.S. banking system. As fears of systemic risk in the U.S. banking system grew, gold prices surged past the $2,000 per ounce mark earlier this month.

The data paints a mixed but overall promising picture, illustrating gold’s enduring appeal as a diversification asset during times of crisis.

China Discovers Largest Gold Mine In Shandong With 580 Tons Of Reserve

The Xiling gold mine in Laizhou, East China’s Shandong Province, has become China’s largest single structured gold mine, boasting a gold reserve of 580 tons.

This significant find came after the Natural Resource Department of Shandong Province unearthed an additional 200 tons of gold resources in the mine, with an estimated economic value of 200 billion yuan.

Owned by Shandong Gold Group Co (SD-Gold), this mine represents a breakthrough in Shandong’s mineral exploration, placing it in the world’s front tier of gold reserves.

China’s gold market continues to flourish. In Q1 2023, the nation produced 84.97 tons of raw gold, up 1.88% YoY, and consumed 291.58 tons of gold, marking a 12.03% YoY increase.

Moreover, China has increased its gold reserves for six consecutive months, reaching 66.76 million ounces by the end of April.

As we’ve discussed, China is not the only country looking to buy more gold. Dozens of nations have increased their gold reserves.

In the weeks and months ahead, we’ll keep an eye on inflation, rising risks of a recession in the U.S., and concerns about the U.S. dollar, which all could influence inflows to gold.