Beware The Math

How the Appearance of Precision Undermines Investment Decision Making

It is comforting to know that two plus two unequivocally equals four, regardless of one’s belief system or mood. As such, math, with its objective clarity and indisputable certainty, has always served as a compelling basis for decision-making. However, it’s crucial to tread cautiously when presented with seemingly mathematical assertions in the unpredictable and uncertain world of economics and markets.

Consider, for example, the “math” released by the Congressional Budget Office (CBO). While presented as exact (to the million when counting in trillions), the inputs are inherently uncertain. The CBO endeavored to distill the erratic ebb and flow of the national economy into neat, mathematical predictions. Moreover, there seems to be an inability to even consider macro downturns, which happen with ever more alarming frequency. Yet, the Fed and investors rely on this “math” for government policy and investment decisions. That has proven to be a costly mistake.

CBO’s Mathematical Miscalculations

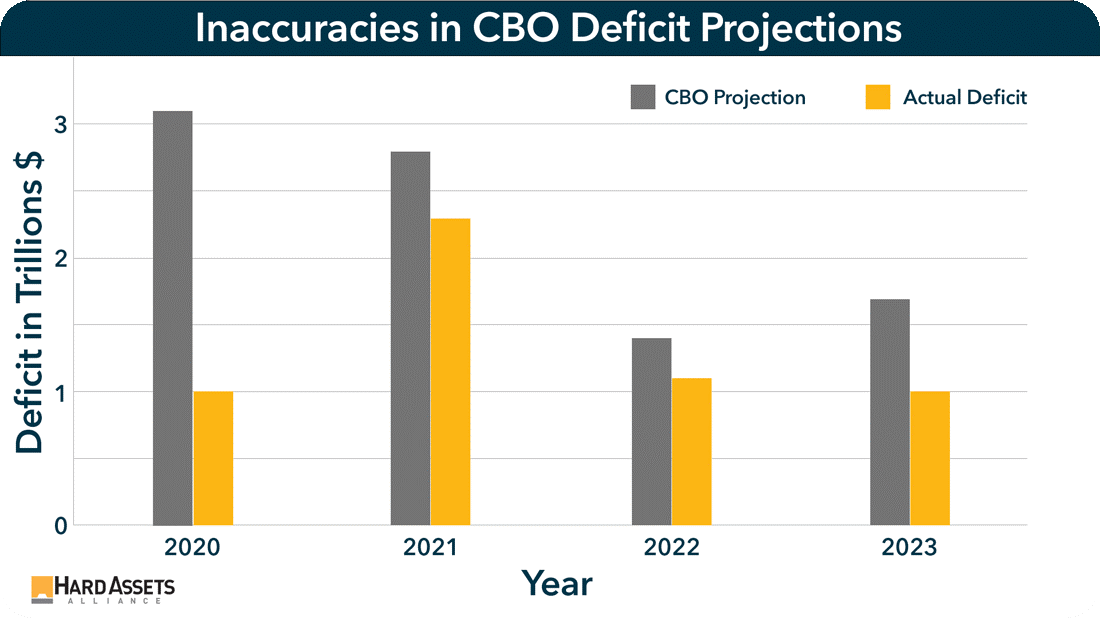

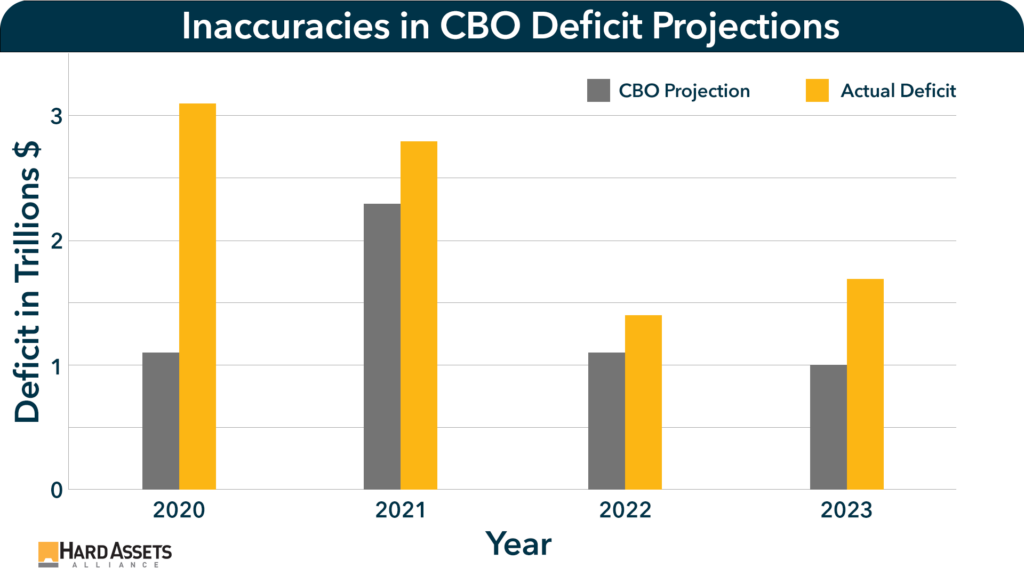

The CBO’s forecast in January 2020 predicted annual deficits ranging from $1.0T to $1.1T for each year starting from 2020 and ending in 2023. However, the unpredictable arrival of a global pandemic rendered these predictions obsolete, with actual deficits ballooning to $3.1T, $2.8T, $1.4T, and $1.7T respectively, for a total underestimation of $4T.

I suppose that the CBO can be forgiven for not considering a global pandemic. But here’s where it gets more interesting. Even with the unfolding of the pandemic, providing the CBO with additional data and opportunities to adjust their predictions, the subsequent estimates continued to miss the mark. In February 2021, while the pandemic was still ongoing, they predicted deficits of $2.3T, $1.1T, and $1T for 2021 to 2023 – an underestimation of $1.5T in total over that period.

This trend of inaccurate forecasting did not end there. In May 2022, despite being more than halfway through the fiscal year, the CBO still underestimated the deficit for 2022 by $400B and for 2023 by $700B. Fast forward to May 2023, again more than halfway into the year, and their estimates for the full-year deficit fell short by $200B. The prediction for the 2024 deficit is $1.6T, seemingly failing to fully recognize rising interest expenses on the growing federal debt and the likely decrease in capital gains tax revenue amidst economic downturns (although partially offset by interest earned on short-term cash investments).

The Doom Loop and the Investment Landscape

In this volatile scenario painted by continuous underestimations and corrections, the Fed and investors now find themselves in what Sven Henrich’s describes as a “perfect doom loop.” Since the deficits have come in higher than what is presented in the math, that means that the national debt has increased more than predicted. Treasury needs to issue a larger supply of debt, which leads to rising yields to clear the market for all this debt. That increases the interest expense, thereby necessitating even more debt. Which leads to less profits and income taxes which provide revenue for the government. Leading to bigger deficits. And once again, the CBO gets the deficit math wrong. Sheesh.

Crafting a Resilient Portfolio When the Math is Unknowable

So, how should an investor respond amidst this uncertainty? While acknowledging the importance of mathematics, one must approach the numbers presented by institutions like the CBO and the Fed with a healthy dose of skepticism. It would seem to me that the only reliable fact is that the CBO will once again understate the deficit and debt leading to more economic pressure and volatility.

This is not to say that it’s time to panic. As an investor, it is crucial to recognize that economies, markets, and individual investment opportunities diverge. One obvious example, job loss in the economy is bad, do not translate neatly into any company’s individual performance; in fact, a company that cuts jobs can become leaner, more efficient, and more profitable.

As such, there is no need to move into an investing bunker, but to construct a resilient portfolio that blends yield, safety, and growth. Here are some strategies to consider:

• Short-duration Fixed Income: These instruments offer a healthy yield while remaining insulated from the possibility of rising rates. They can also be easily redeployed into other investments opportunistically.

• Quality Equities: Consider ETFs like SCHD, which aggregates a portfolio of high-quality companies known for their reliability and robust dividends, offers investors a chance to partake in the stability of blue-chip companies while still enjoying a diversified exposure. This blend of quality and diversification helps in constructing a resilient and shock-absorbent portfolio that is equipped to navigate through the unpredictable currents of the market, regardless of the mathematics.

• Precious Metals: Notwithstanding the “higher for longer” rhetoric, the probability of monetary intervention remains as high interest rates portend higher deficits and financial accidents (a la Silicon Valley Bank and Signature Bank). Gold and silver offer a tangible, finite resource that historically holds its ground amidst monetary fluctuations and interventions.

The real takeaway from this note is not about specific investment advice; rather, it’s a word of caution about approaching economic numbers with a healthy skepticism, especially when these figures don a mask of mathematical certainty. While navigating financial markets and investments, remember that some numbers presented with precision often hide a core of uncertainty and unpredictability. Approach forecasts and projections with a discerning eye and be prepared to adjust your investments accordingly.