As widely expected, the Fed raised interest rates last quarter, dampening gold’s ascent and impacting other markets as well. This was the backdrop for the third quarter of 2023.

Our quarterly report summarizes how gold and other major asset classes performed in Q3 and year-to-date. We also list the major catalysts to watch in the remaining quarter of the year—it’s a sobering list.

Gold in Q3: Fed Pauses the Pause

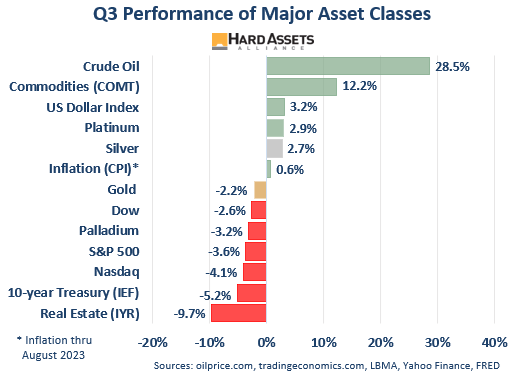

Gold was down a modest 2.2% in Q3, after declining 3.4% in Q2.

The main culprit for gold’s weakness was the Fed’s “higher for longer” mandate, which most markets didn’t like. After pausing earlier this summer, the board raised interest rates a quarter point on July 26, then kept them the same at the September 20 meeting. The range on the Fed Funds rate is currently 5.25% to 5.50%.

And check out silver… it rose 2.7% last quarter, beating out gold, equities, Treasuries, and real estate.

Of the other precious metals, platinum was up 2.9% while palladium fell 3.2%.

Oil was the big winner, along with the commodity ETF.

Gold YTD: Steady as She Goes

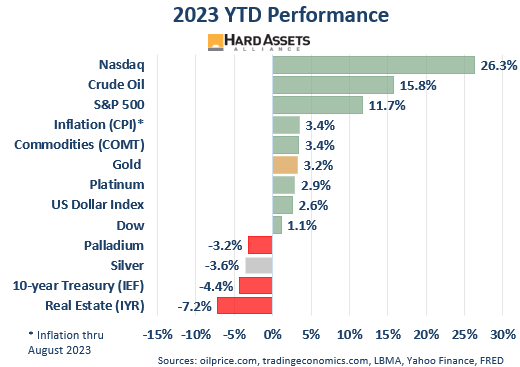

To the surprise of some investors, gold is up 3.2% year-to-date.

You’ll notice that both gold and the US dollar are up on the year. This shows a rising dollar is not always negative for gold and that at times they can both rise together.

It should also be pointed out that gold has served as a better hedge than the 10-year Treasury, which is down even more than silver!

The strongest performers so far this year are the Nasdaq, oil, and the S&P 500. Real estate is the weakest of the major asset classes.

The 2023 Watch List: How Does the Year End?

There are numerous issues that could impact the economy, markets, or geopolitics. The water in the pot indeed seems to be getting hotter—and to make matters worse most of the issues are interconnected, as this list shows…

US Federal spending is up 30% since January 2020… which has led to M2 Money supply rising a whopping 36%… which has led to the US Federal debt now reaching over $33 trillion, a staggering figure that relentlessly keeps growing.

Interest payments on Federal debt reached $909.5 billion in Q2, which means it will be a trillion dollars annually by year-end. For comparison, it was $517.6 billion at the end of 2020. The trend seems to be accelerating, too; on October 3, the US added $275 billion in debt—yes, in one day.

The US 30-year yield has hit the highest level since 2007. Incredibly, the ultra-long duration Treasury bond ETF has lost more (-58.3%) than the S&P 500 did during the Great Financial Crisis (-56.0%). The 60/40 portfolio is not providing the combination of gains and protections many have been led to believe.

Meanwhile, according to Bloomberg Finance, short positions in US Treasuries hit the highest levels ever at the end of September.

Rising interest rates weigh on, among other things, corporate profits. Borrowing costs for S&P 500 companies have ticked up by the largest amount in nearly two decades. This will affect profitability, which in turn would logically impact stock prices.

This also affects investor psychology. Investors withdrew $78.6 billion from U.S. taxable bond funds through August. Even though yields are at a 15-year peak, investors are opting for safer, cash-like assets. As Bloomberg says, “the hesitancy remains prevalent as the market awaits clear signals of rate stabilization.”

Higher rates also naturally affect homebuyers. The average 30-year mortgage in the US is now above 8%. This will further slow housing demand.

The commercial real estate market appears set to weaken substantially. Bloomberg’s Markets Live Pulse survey announced that respondents believe office prices are “due for a crash.” Further, they believe they will only rebound after a severe collapse! An even greater majority says that US commercial real estate prices won’t hit bottom until the second half of 2024 or later.

Roughly $1.5 trillion of commercial real estate debt is due before the end of 2025. Refinancing at current interest rates will be painful and complicated, and selling won’t be easy since so many buyers are convinced the market is not close to the bottom.

The US credit card delinquency rate is starting to buckle. Rising gas prices and student loan payment restarts this month will likely push the delinquency rate higher.

Defaults in corporate private credit are also growing. Private debt defaults will reach 5% by early 2024, says Bank of America, as portfolios see an estimated one-third of deals come due in the next two-and-a-half years.

Add it all up and…

Recession fears appear more valid than ever. On top of the inverted yield curve (2-year Treasury higher than the 10-year), we have major auto and healthcare worker strikes, the resumption of student-loan repayments, a government shutdown that may yet come back after the stop-gap spending deal lapses, dwindling pandemic savings, painfully high interest rates, and soaring gas prices. A recession appears baked in the cake more than ever. Research shows gold typically rises during recessions.

Meanwhile…

Gold demand remains high… in widely reported news, Costco, who has been offering one-ounce gold bars, said it has typically sold out of them “within a few hours.” The retailer limits them to two per member, but Reddit users have posted prolifically about their struggles to get their hands on them.

Gold buyers in the UAE are piling in. One retailer reported, “This year’s festival buying has certainly started early for gold.”

At the end of September, American Eagle silver sales at the US Mint exceeded full-year sales in 2018, 2019 and last year, with a full quarter to go. Meanwhile, the current 3-year supply deficit in silver totals an incredible 430.9 million ounces.

Gold/silver ratio: The ratio (gold price divided by silver price) remains stuck in the 80s, a full third above its long-term average of 55. It fell to 32 in 2011, and 17 in 1980. As such, silver remains deeply undervalued relative to gold. Silver usually trails gold in the initial stages of a bull run but surpasses it by the time the run is over.

- The need for a “crisis buffer” remains high. Recession risks, high interest rates, and a stubborn Fed leave investors with few places to turn for a safe haven. History shows gold offers a strong defense when the fallout begins.

Jeff Clark

Senior Analyst

An accomplished analyst, author, and speaker, Jeff Clark is a globally recognized authority on precious metals. The son of an award-winning gold panner, with family-owned mining claims in California, Arizona, and Nevada, Jeff has deep roots in the industry. An active investor, with a love of writing, Jeff eventually became a mining industry analyst, including 10 years as senior editor for the world-renowned publication BIG GOLD. Jeff is also a regular conference speaker, including at Cambridge House, MoneyShow, New Orleans, Silver Symposium, Wealthion, and many others. Today, he provides free mining stock analysis at TheGoldAdvisor.com.