I recently attended a major pension fund conference where a number of highly decorated speakers shared their perspectives about the present global geopolitical and economic terrain. Although gold was not the centerpiece of these discussions, the synthesis of insights from these renowned thought-leaders bolstered a simple yet profound case for gold.

The Inexorable Case for Gold: A Distillation of Global Shifts

Our financial world is undergoing a seismic shift. Post-WWII, the globe largely orbited around the economic and political gravity of the United States. However, the landscape has morphed into a multipolar world, one where several countries (especially China) are forging new paths and reshaping the order that has prevailed for over seven decades. Goldman Sachs recently released a report mirroring my thoughts on this multipolar world.

Imperative One: The Quest for a Credible Currency

In this new world order, nations are seeking to secure supply chains, bolster their military prowess, and establish economic systems that are not tethered to the United States. As part of this endeavor, these countries need to establish credibility and autonomy for their currencies, stepping away from the once-unquestioned dominance of the U.S. dollar (and U.S. treasuries). Historical lessons remind us that credibility of a currency often stems from tangible backing — and gold has been the star in this role for centuries.

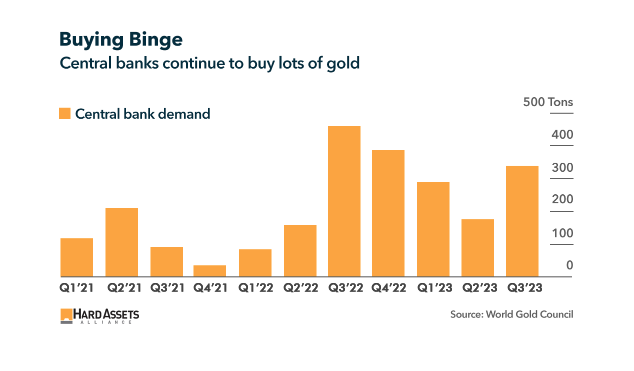

The U.S. dollar itself climbed to prominence backed by its gold reserves, setting a precedent. While I remain skeptical about a direct return to the gold standard for currencies like the Chinese Yuan or those within the BRICS alliance, we are witnessing a strategic accumulation of gold reserves. These moves are less about a direct peg to gold and more about fortifying economic independence and resilience, potentially diminishing the unilateral influence of the U.S. dollar. This dynamic has been firmly in place for the last two years, as central bank buying of gold has reached record levels and remains robust (see chart below). This dynamic will underpin a strong and steady demand for physical gold for the foreseeable future.

Imperative Two: The Debt Dilemma and the Inflationary Escape

Turning to our own shores, the United States is now contending with a towering federal debt — exceeding $33 trillion. The paths to paying down that debt — unprecedented economic growth, substantial tax hikes, and slashing entitlements — are politically and socially challenging. They may even be entirely implausible given the current political landscape.

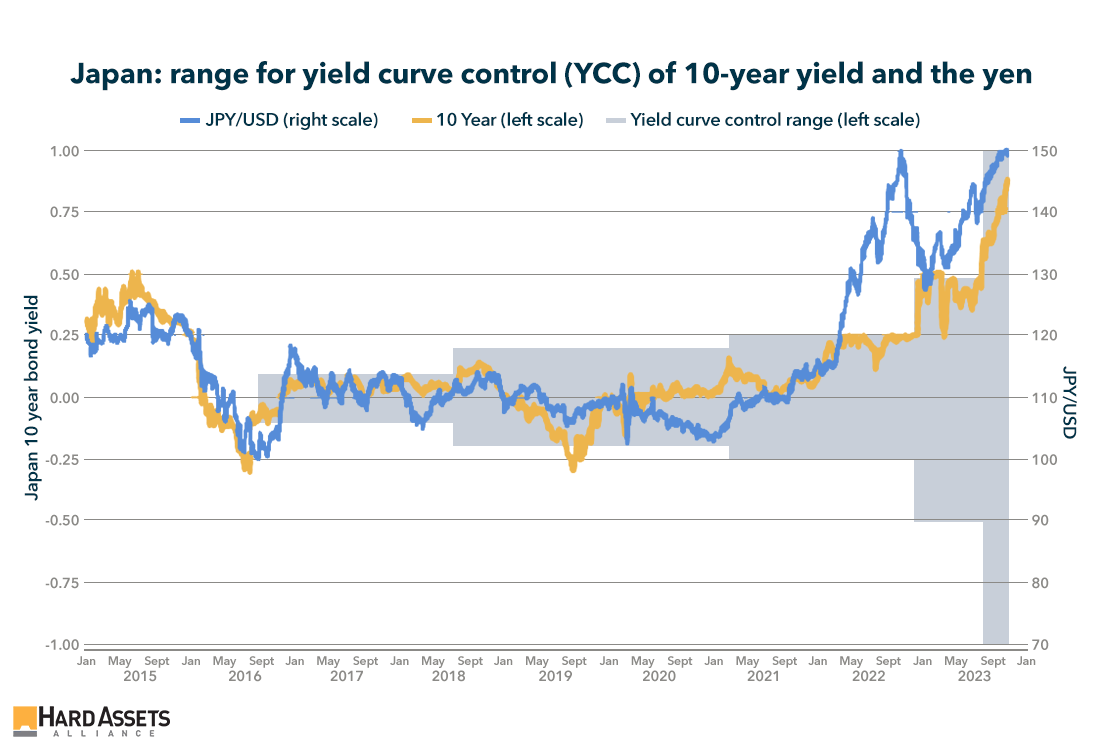

And while today we see positive real rates for the first time in decades, it can only last so long as we are willing to risk further erosion in confidence in treasuries or worse, a default. Enter strategies like ‘yield curve control,’ a concept not just theoretical but actively employed by Japan since 2016. Yield curve control is a monetary policy strategy where a central bank targets specific long-term interest rates to remain at a set level. In practical terms, it involves buying or selling government bonds to maintain the rate target. When a central bank commits to such a policy during a period where inflation rates exceed the targeted bond yields, it leads to negative real interest rates. This means that the return on bonds, after accounting for inflation, is less than zero — effectively, the debt is eroded in real terms. Also eroded is the value of the currency, as the chart below shows the depreciation of the Yen v. USD.

This is an escape route from debt that leans on inflation as a subtle decayer of real value. For creditors, this is a worrisome scenario, but for gold, it’s a bullish signal. Gold historically acts as a hedge against inflation and currency devaluation, and thus, this policy indirectly strengthens the case for gold investment. If you need any further proof, gold has hit a record price in Yen.

The Long-Term Bullishness of Gold

These two imperatives — the global push for currency credibility and the monumental U.S. debt challenge — are deep, structural changes that reflect the evolving nature of geopolitical power and economic necessities. While the gold price will of course ebb and flow daily based on the news cycle or hedge fund positioning, the long-term trajectory for gold appears not only positive but virtually inevitable. As such, we continue to recommend gold as a permanent and long-term component of your investment portfolio.

Steven Feldman

CEO, Hard Asset Alliance