A Global Competition Happening in Secret

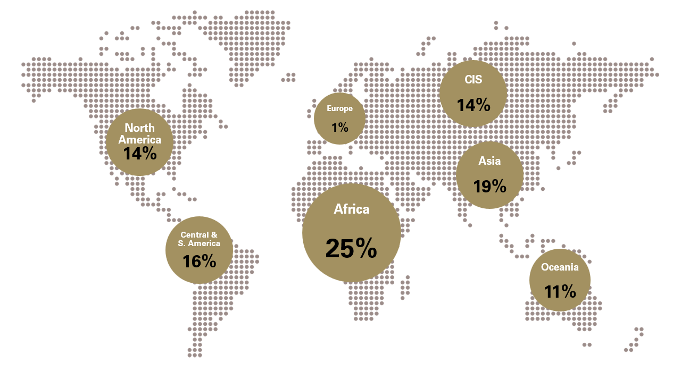

Every major continent on the planet is in search of gold.

In the chart from the World Gold Council below, you can see how geographically diverse gold mining has become.

According to estimates from the WGC, approximately 209,000 tons of gold have been mined throughout human history. Of that total, bars and coins account for 21%, central banks hold 17%… and a whopping 46% of all gold is made of jewelry.

For thousands of years, in every major society around the globe, gold has been prized as a valuable treasure. And because gold is indestructible, virtually all of the gold humans have mined is still available in one form or another.

Despite thousands of years of popularity, gold is still rare thanks to its low stock-to-flow ratio. Every year mining production adds approximately 3,500 tons of gold to the total supply, which equals a 2% incremental increase.

That’s one of the biggest differences between gold and modern currency like the U.S. Dollar.

The Fed has the power to print a trillion more dollars with the snap of their fingers. But no matter how hard you try, you simply can’t double the gold supply in a single year.

Owning real physical assets is more secure than paper assets. But simply buying gold isn’t always enough – you still need to do your due diligence when storing any sizable portion of your funds with any gold company or vault…

A Real-Life Retirement Heist

In 2021, 70-year-old entrepreneur Nancy O’Hara, was worried about an impending recession…

In order to secure her retirement, she researched gold and signed up for Regal Assets’ “Gold IRA” program. Encouraged by positive reviews and the credibility of a prominent member of Regal Assets, she confidently transferred about $500K of her retirement savings in Regal Assets’ “Gold IRA” program.

After eight weeks passed without any delivery, she contacted Regal Assets and a series of excuses followed…

Unbeknownst to O’Hara, many other Regal Assets customers, predominantly in their sixties and seventies, faced similar circumstances. In the past year, at least three lawsuits have been filed against Regal Assets by customers alleging they never received their purchases at all.

In total, authorities in Texas estimate customers lost a combined total of $4.6 million in retirement assets.

But this is where the story gets even more absurd…

During this entire saga, founder of Regal Assets Tyler Gallagher, has gone missing. Without anyone to serve, and a dwindling supply of cash on hand, customers like O’Hara face an uphill climb recovering their funds.

Unfortunately, this story highlights the importance of doing proper research on the company you do business with. When investing in gold you need to find out where the gold is being kept, who watches over it, and how the ownership is determined. In short, you want:

- Separate chain of custody

- 100% allocation to you, held in your name, you own it outright

- A reputable vault with armed guards, insurance, and independent auditing.

Any firm you do business should have an independent third-party custodian, who is not connected to any of the dealers with whom it does business. And whoever your custodian is they should have their depositories verified regularly by independent auditors.

It’s the only way to ensure your metals are truly safe.

We’ve compiled our research on the topic here, including three red flags to look out for…

How Long will the Gold Boom Last?

During economic crisis, war, and global strife – gold stands the test of time and that’s as true today as it was centuries ago.

In the face of growing inflationary concerns, escalating geopolitical tensions, burgeoning global debt, soaring interest rates, and an ongoing banking crisis, investors worldwide are reassessing their investment strategies and recalibrating their outlooks amidst challenging market conditions.

And so far, gold has been one of the biggest beneficiaries.

One of the most substantial drivers for gold’s resurgence is the deep-seated concern about the dependability of other liquid assets. In Q1 of 2023, American investors purchased 32 tons of gold – the highest quarterly amount since 2010, likely because recession fears. In 2022, central banks acquired 1,079 tons of gold bullion, setting a new record since data collection began in 1950.

Though gold is currently enjoying its time in the limelight, predicting where it will go next is a complex task. Despite hitting new peaks earlier this month, gold’s value has now dipped to around $1,975/oz.

Nevertheless, if any number of these ongoing issues escalate, it could propel gold to new heights.