What the Debt Ceiling Means for Gold

It’s time to face the inconvenient truth… the politicians playing with chicken with the debt ceiling, they may not reach an agreement in time to stave off a disaster.

If the United States were to default on its debt, it would trigger a massive economic catastrophe, potentially leading to a significant downgrade in the quality of life for countless middle-class Americans.

The repercussions would extend far beyond our borders, as a default would diminish global demand for the US dollar. This ominous shift threatens America’s status atop the global economic powers.

We can already see the early signs of this crisis materializing before our eyes…

De-dollarization: The Dollar’s Reserve Currency Decline

The US dollar’s status as a reserve currency is declining at a faster rate than generally believed, according to analysts Stephen Jen and Joana Freire of Eurizon SLJ Capital.

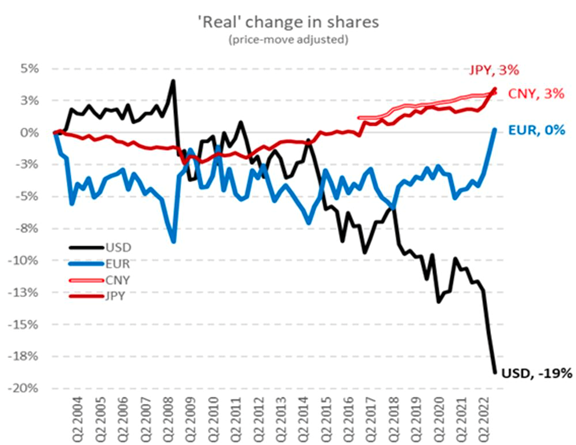

After adjusting for exchange rate movements, they claim the dollar has lost approximately 11% of its market share since 2016 and twice that amount since 2008.

This accelerated decline of the dollar is attributed to nations seeking alternatives following sanctions triggered by Russia’s invasion of Ukraine.

Several emerging economies, particularly from the global south, have been particularly startled by the US and its allies’ actions against Russia. Furthermore, smaller nations are experimenting with de-dollarization, while China and India seek to internationalize their currencies.

Despite this, the dollar’s international role remains unchallenged for now, as developing nations still depend on it due to its liquid and well-functioning financial markets.

Nevertheless, it’s important to consider the fact that the dollar’s status is not guaranteed as the world’s reserve currency indefinitely.

UBS Releases Report – Three Reasons to Buy Gold Now

After gold surged past $2,000 per ounce earlier this month, gold has dipped back below the $2,000/oz milestone.

But gold investors have reason to be hopeful. Economists at UBS just published a report where they say gold is likely to break its all-time high later this year due to multiple factors in the short and long-term.

Firstly, central banks are projected to buy around 700 metric tons of gold this year, significantly higher than the average of below 500 metric tons since 2010. This trend is expected to continue due to heightened geopolitical risks and surging inflation.

Secondly, broad US Dollar weakness is supporting gold. Gold typically performs well when the US Dollar weakens due to their strong negative correlation.

Lastly, recent data coming out of the U.S. showed the country’s growth is slowing. Rising US recession risks may trigger safe-haven flows to gold. Since 1980, gold has outperformed the S&P 500 significantly during times of recession.

This may not be news to Hard Assets Alliance customers, as we’ve consistently underscored gold’s safe-haven status, its inverse relationship with the US Dollar, and the increased demand from central banks.

But what’s really important is, these insights are being echoed by major financial institutions like UBS, which could help boost gold’s perception among a wide audience of wealthy investors.

Could we see gold rise to new all-time highs before the end of the year, like UBS believes?

Only time will tell.

Brandon Sauerwein

Precious Metals Writer, Hard Assets Alliance

Dennis Miller is the consumer’s voice for all things retirement. He covers all things investing, and his website, blog articles, and newsletter should be a go-to resource for anyone serious about managing their money. Sign up for his free newsletter here.