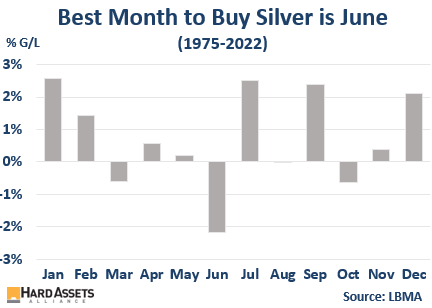

June – the Primetime to Boost Your Silver Portfolio?

Considering adding silver to your portfolio?

The data suggests that right now could be the ideal opportunity.

We delved into the historical price data of silver, analyzing it on a month-by-month basis, and found an interesting trend:

Since 1975, June is often the worst performing month for silver. Our comprehensive data analysis shows that on average, the price of silver drops over 2% in the month of June.

While that may sound bad initially, it’s important to remember that downturns in price present an excellent buying opportunity for long-term investors to buy at discounted rates.

Many investors who seized the opportunity to buy silver in June were rewarded with a discounted entry point, followed by substantial growth in the succeeding months.

In the grand scheme of things, pinpointing the exact low point to buy into should not be your end goal. Instead, the focus should be on increasing the quantity of precious metals you hold. Assets like physical silver and gold tend to perform inversely to the conventional market, providing a safety net during stock market downturns.

That’s why now is the time to build up your precious metal portfolio – while prices are still affordable. You could be left in the dust once prices surge higher. In the end, this could lead you to paying a higher price AND a higher premium.

So, that’s why every investor needs to ask themselves: Is your portfolio ready to weather whatever the market brings?

If not, June might be your golden (or rather, silver) opportunity to help secure your financial future.

“Commercial Real Estate is Melting Down Fast”

Elon Musk, a leader in electric vehicles and space travel, is now turning his attention to an unexpected industry…

Real estate.

Musk recently took to Twitter, voicing his concerns that the pandemic-induced work-from-home trend will soon lead to a rapid meltdown of commercial real estate – and home values could soon follow.

In line with Musk’s prediction, recent data suggests a downward trend in housing prices.

The median existing-home sales price declined 1.7% to $388,800 in April compared to a year ago, according to the National Association of Realtors (NAR). This is the third consecutive month of year-over-year national home price declines after a 131-month streak of record increases.

But Musk argues we’re only seeing the tip of the iceberg in terms of the impact on the real estate portfolio, with more serious implications expected later this year.

With record vacancies in cities around the globe, the future of commercial properties looks uncertain. As we move deeper into the year, only time will reveal the accuracy of Musk’s dire predictions.

However, one thing is for sure: his remarks have stirred the pot, prompting industry insiders and casual observers alike to keep a closer eye on the real estate market.

Is the U.S. Dollar’s Supremacy in Jeopardy?

This Thursday June 8th, leaders of the BRICS nations — Brazil, Russia, India, China, and South Africa — are convening to discuss the inclusion of potential new allies (Saudi Arabia, Iran, and the United Arab Emirates) and a future less reliant on the U.S. Dollar.

From Russia’s conflict with Ukraine to escalating tensions between the U.S. and China, this summit comes at a time when many of these nations are finding themselves at odds with Western powers. Now many are exploring alternatives to the U.S. Dollar, with a BRICS currency proposed as a potential solution.

Starting a new global currency is no easy task. Mutual distrust among the BRICS nations, along with the vast differences in their economic systems, could potentially impede the process.

While experts currently believe that the U.S. Dollar’s hegemony is not at immediate risk due to these challenges, the move by BRICS nations signals a shift in global economic power dynamics.

As American citizens and the rest of the world watch these developments, the implications could be profound, potentially affecting your standard of living, international trade, investments, and the global balance of power.

Stay tuned as we continue to follow this evolving story, providing timely updates and insights into the shifting global economic landscape.