An ideal way to invest is to identify an asset that is both undervalued and poised to rise. Easier said than done, but if an investor can find an opportunity that meets those two criteria, they can put the odds greatly in their favor.

Well, that may be exactly what we have with silver right now. See what you think…

Criteria #1: Relative to other assets, silver is deeply undervalued. There are a number of ways to show this, but here’s another one that dawned on me while watching the recent fall in the stock markets.

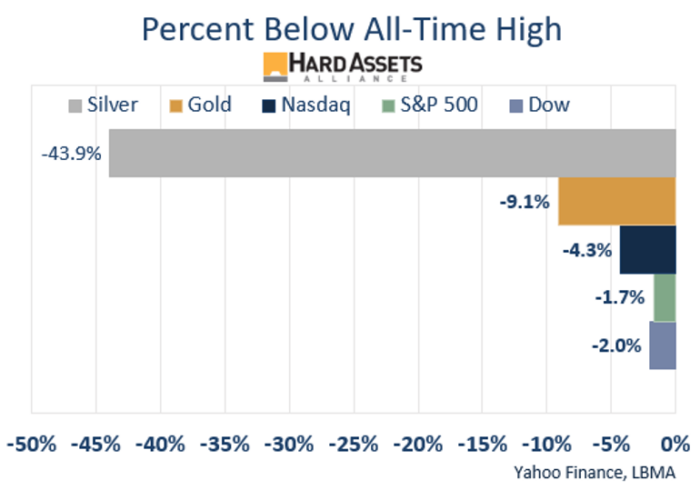

The S&P 500, Dow, and Nasdaq all kept making new all-time highs over the past year. They finally had a correction, so I wondered how far they were from their all-time highs compared to silver.

This chart shows the percentage each asset is currently below its all-time high (as of Friday, May 21).

Despite the correction in the general stock market, silver is further from its peak than all the major indexes. It is nearly 44% below its all-time high, while stock markets still hover near theirs. Gold is only 9.1% from its peak.

Would you rather buy an investment hovering near all-time highs, or one that’s almost half of it? Clearly the better value right now is with silver.

Criteria #2: Timing an investment purchase is a never-ending dilemma, because you never know for certain what the price will do in the short-term.

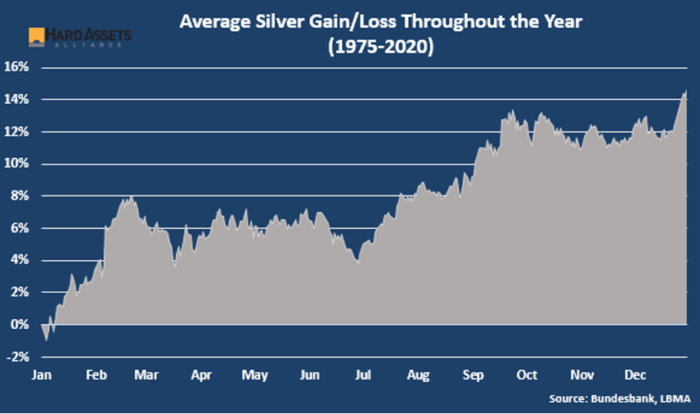

But what if you had data that spanned 53 years and showed a specific tendency about its price behavior, at a particular time of year? There’d still be no guarantees, but it could potentially give you an edge.

That’s what we have with silver…

We’ve showed this chart before, but the timing right now is compelling. It shows silver’s average daily gain and loss over the past 53 years—look what tends to happen to the price in June.

From now until the 4th of July holiday, the silver price has a strong seasonal tendency to fall. Which, if the averages play out, would be the lowest levels for the rest of the year and a great buy point for long-term holdings.

You can see what the price tends to do after the holiday. It is indeed “poised to rise;” from then till the end of September is its strongest time of year.

For those of you that have an “accumulation” mentality, this can be valuable intel. It’s basically how I handle buying silver (and gold), too; I swoop in on dips and corrections and big selloffs.

My confidence in the big picture for silver gives me the confidence to buy when the price softens. I’m accumulating in the present for a big payday in the future. Pullbacks are thus a chance for me to pay less.

Of course there’s no guarantee seasonal trends will play out. There are a lot of factors that can impact silver’s price in the short-term.

But this data does tell us one thing:

- Be on the lookout for a potential decline in the silver price. Build cash to take advantage of it if the opportunity comes.

Whatever you do, I hope you’re prepared to pounce on the next dip, whenever it may arrive.