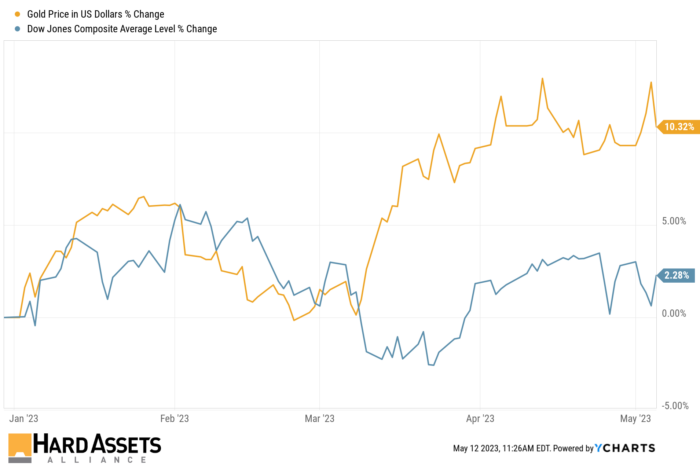

It’s an exciting time to be a gold investor. Gold briefly reached a record all-time high last week. Meanwhile, the Dow is struggling to deliver meaningful gains year-to-date:

And there might be more good news for gold, as you’ll see ahead, there’s a lot of potential macroeconomic tailwinds that could increase gold demand even further in the months ahead…

Gold Reaches All-Time Highs

Gold prices hit new all-time highs earlier this month, briefly touching as high as $2,082/oz.

This new all-time high for gold comes after:

- The Fed just raised its benchmark interest rate to its highest level in 16 years. That’s ten consecutive meetings in row the Fed has raised rates to try and curb inflation. Rates are now between 5 and 5.25%, making borrowing significantly higher for businesses and everyday people.

- Yet inflation remains stubbornly high even after a slight moderation. Many Americans are still feeling stressed by the rising cost of living. But economists do not share consensus on the causes (although signs point to a tight labor market being the biggest influence).

- Meanwhile, we’re not out of the woods of the banking crisis. Even Charles Schwab, the nation’s largest publicly traded brokerage with $7 trillion in AUM, saw shares drop 31% amid the regional banking crisis as account holders withdrew funds. We’ll see if things get worse and which bank might be next.

All of these factors and more are contributing to gold’s recent surge higher. Keep an eye on these situations as they continue to develop.

American’s Confidence in Fed Chair Hits Record Low

According to Gallup’s annual Economy and Personal Finance survey, only 36% of respondents had a “great deal” or “fair amount” of confidence in Powell to do the right thing for the economy – the lowest rating of any Fed Chair.

The poll also found that Americans are less optimistic about the state of the U.S. economy than they have been in recent months and that Biden is at a low point in his overall job approval rating.

It’s clear Americans are growing extremely concerned about the economy – and right now, none of our leaders are inspiring much confidence.

With the U.S. facing a deadline to increase the nation’s debt limit, and the threat of an economic recession looming, the job won’t get any easier.

Gold IRAs are Becoming Mainstream

The Wall Street Journal just published this headline on their front page.

Once a rare sight, the article discusses how gold IRAs are becoming an increasingly popular investment option for retail investors looking to invest in precious metals.

This comes at a time when many new investors seem to be waking up to the benefits of owning gold…

- According to the World Gold Council, Americans bought 32 tons of gold in Q1 of 2023 – the highest quarterly amount since 2010.

- And they’re not alone – big institutions are buying more gold too. According to the World Gold Council, the world’s central banks more than doubled their gold buying in 2022.

The WSJ did a fantastic job explaining why an investor might want to consider gold.

But we wanted to dive into more detail into some of the potential pitfalls you should look out for when considering a gold IRA.

Unfortunately, over the years many gold companies have been caught using some very shady business practices. The good news is, spotting these nefarious companies is very easy once you know what to look for…

At Hard Assets Alliance, we’ve done extensive research on the most common gold IRA traps and how to avoid them.

Before you invest with any gold IRA company, take 5 minutes and check out our free report.

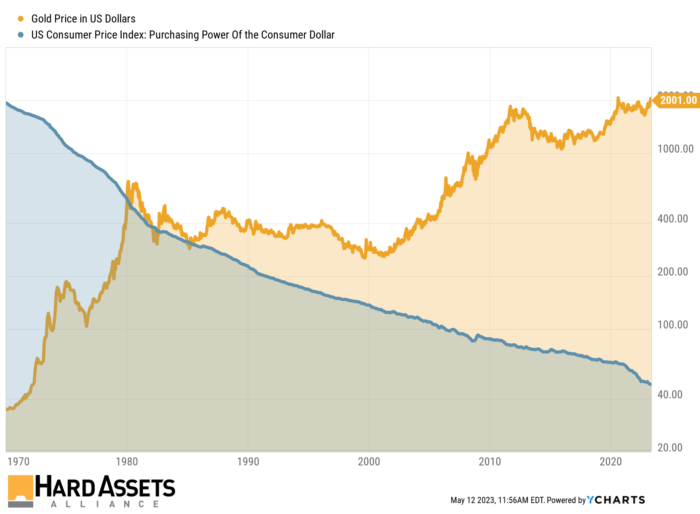

Amid the 24/7 news cycle and focus on the short-term price movements, it’s easy to lose sight of the big picture

So, we’ll close this article with a chart comparing the purchasing power of the U.S. dollar and the price of gold…

The U.S. Dollar vs. Gold

Over the long run, it’s clear the dollar isn’t “getting stronger” in real terms, despite what you hear on the news. In fact, the U.S. Dollar has lost 87% of its purchasing power since 1971 – the year the dollar stopped being backed by gold.

Each year that passes the dollar buys less and less. Meanwhile gold has been steady.