The ebb and flow of gold cycles have the power to create large fortunes…

And today, we stand on the cusp of an extraordinary opportunity, one that history may remember as the dawn of the most lucrative gold cycle yet.

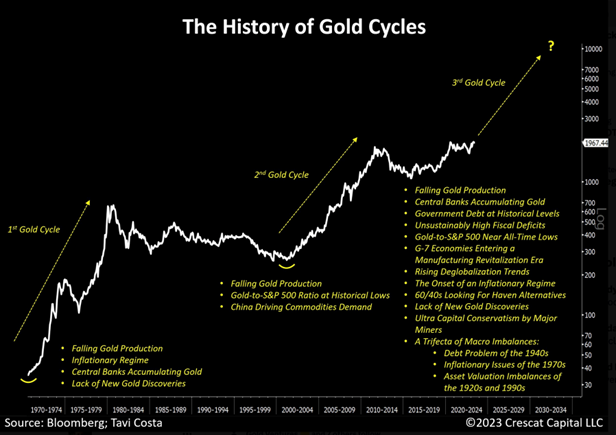

At least, that’s what Tavi Costa believes. Tavi has worked as a Partner and Macro Strategist for Crescat Capital for over a decade and he recently shared an incredible chart outlining the many reasons to be extremely bullish on gold as we enter the next market cycle…

We see many parallels today with the scenarios of the 1970s and early 2000s. However, Tavi underscores a distinct difference – the trifecta of macro imbalances currently unfolding.

The U.S. National Debt has soared past $33.7 trillion and continues to climb daily. With interest rates on the rise, servicing this debt is becoming pricier than ever. We now spend more on servicing our national debt than we do our defense spending.

On top of that, new inflationary pressures are pushing many Americans to take on more debt just to keep up with escalating prices. A recent Clever Real Estate survey found that over half of Americans (53%) have reached their credit card limit at some point, and 29% admit that they max out their credit card every month.

At the same time, many assets like stocks and real estate face potential rebalancing after years and years of positive gains. According to the McKinsey Global Institute, asset price inflation over the past two decades has created about $160 trillion in “paper wealth.”

On the verge of the third gold cycle, Tavi’s analysis suggests a massive shift, as multiple factors align to boost gold’s prospects — potentially redirecting a tidal wave of new wealth into precious metals.

If Tavi is right, now could be the perfect time to invest in gold, an asset class that is gaining favor among investors. According to a 2023 Gallup poll monitoring public opinion on economy and finance, gold has surged in popularity among U.S. adults as one of the “best long-term investments.”

But Here’s the Key…

Only a select group of savvy investors have discovered that there’s a little-known gold account that offers major tax savings. Imagine keeping an extra 28% of your gains away from the IRS and in your portfolio instead.

Well, turns out that you can with a precious metals IRA from Hard Assets Alliance.

Don’t just watch the next gold cycle unfold – let’s lead it. Click below to learn more about how a gold IRA could be your vehicle to retirement prosperity.