Latest News and Articles

-

Gold Market Report – May 08, 2024

Overnight: Gold was a bit choppy last night and either side of unch ($2314), trading between $2304 – $2321. It was pressured on the downside by an improving US dollar, as the DX advanced from 105.41 – 105.64. The greenback was helped by: However, gold was supported by a rate cut by the Sweeden’s Riksbank…

-

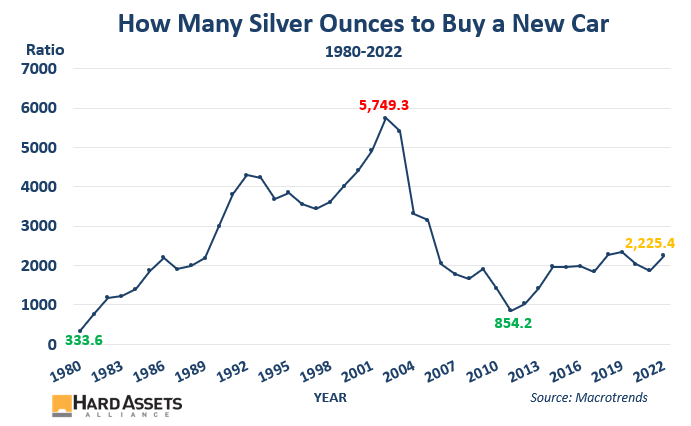

Jeff Clark: Which Luxury Items Priced in Silver Will Get Cheaper in 2023?

Something fun to think about as you break for the holidays… Ever thought about what you might buy with your proceeds from silver? It’s too early to do that now, and we’ll have to briefly swap for currency to do it, but if we’re right about where the silver price is headed—and simultaneously where the…

-

Jeff Clark: 22 Things About 2022 That Hint About 2023 for Silver and Gold

What can we expect from gold and silver in 2023? Part of effectively answering that question is to look at the context of what took place this year. Nothing happens in a vacuum, after all. With that in mind, see if this review of 22 things that happened with gold and silver in 2022 helps…

-

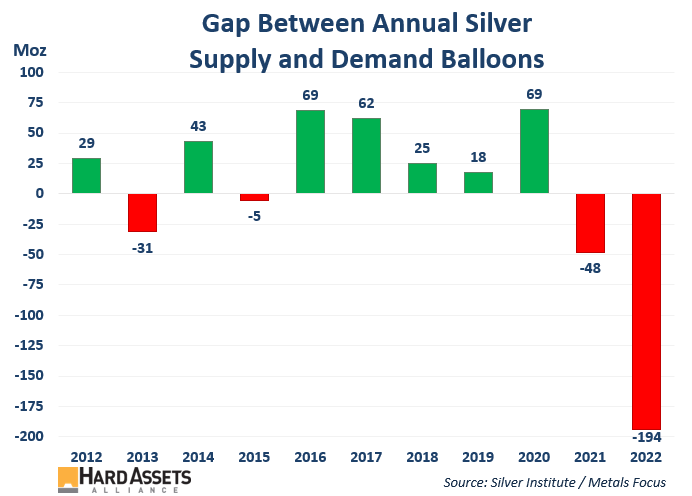

Jeff Clark: This Factor for Silver is Suddenly in Play

Most analysts will tell you that the balance between supply and demand isn’t really a factor that drives the silver price. Historically that’s true—it’s usually investment demand, or lack thereof, that has the biggest impact on price. But suddenly here in late 2022 we are departing from historical norms… There is a widening gap between…

-

The Big Hint About Silver from the Silver Miners

I saw an analyst report from a bank that estimated what the primary silver producers would generate in free cash flow this year. It wasn’t pretty. However, it carries a direct hint about where the price of silver is headed. While it doesn’t mean a surge in the silver price is imminent, the industry has…

-

How Long Will It Take the Fed to Lower the CPI to 2%? 3 Questions with Troubling Answers

Fed Chair Jerome Powell has been insistent that the central bank will lower inflation to 2%. The Consumer Price Index (CPI) is the primary way the Bureau of Labor Statistics measures the change in consumer prices, and the Fed watches this data closely to make some of their decisions. “We are resolute in our goal…

-

These Charts Show More Currency Creation is Guaranteed – and 3 Guesses How Gold Responds

It’s not very often you get to use the word ‘guarantee’ and be right about it. But this just might be one of those times. Question: what do you get when you combine a debt-based monetary system with soaring interest rates? If debt levels are rising, and the federal government has to pay interest on…