Latest News and Articles

-

Gold Market Report – May 13, 2024

Overnight: After surging from $2304 to a 3wk high at $2360 (resistance at down trendline from 4/12 $2432 ATH held) in its last 2 sessions, gold pulled back overnight. The yellow metal retreated in a range of $2365 – $2339, and fell below Friday’s $2345 low. Gold’s decline was buffered by a modest decline in…

-

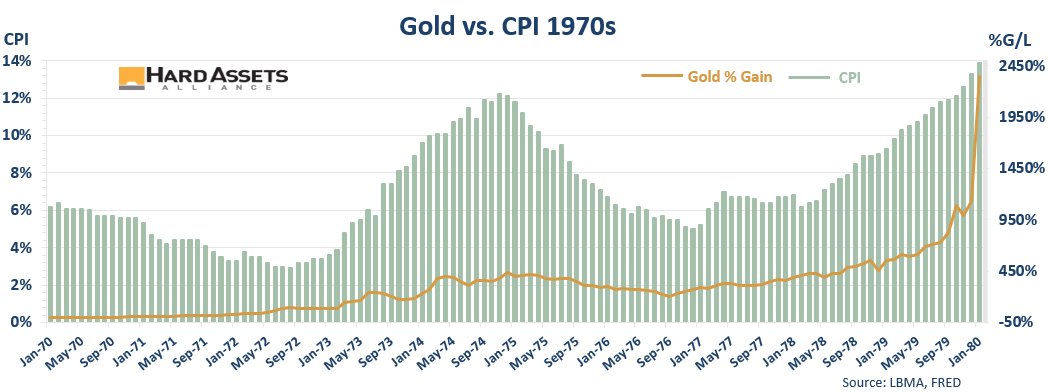

Silver & Gold’s Historical Correlations to High Inflation: This Answers Some Questions

Probably the biggest knock against gold and silver right now is that they’re not rising in response to spiking inflation. This is what many investors know them for, after all. Yet despite the CPI—the Consumer Price Index that tracks price changes in everyday goods and services—reaching 40-year highs, gold and silver prices have been weak.…

-

Robert Kiyosaki: Worst Crash Of Our Lifetime Ahead, Here’s What The Wealthy Are Doing Says Rich Dad

With inflation driving the costs of living higher, real wages falling behind and financial assets having one of their worst years ever so far, it’s a tough time to build wealth right now. And it’s likely to get even worse, says today’s guest, Robert Kiysosaki, author of Rich Dad, Poor Dad, the #1 best selling…

-

Could Home Prices Crash As Much As In 2008?

Housing analyst Nick Gerli returns to the program to warn how swiftly the prospects for home prices are eroding. Confidence in the housing market was supreme just a month or two ago. But suddenly that confidence is vaporizing as an increasing number of experts now caution of a “full blown” correction ahead. Rising mortgage rates are a huge part of the…

-

Why Everything That Can Go Wrong From Here Likely Will | Pomboy & Atwater

People are tired of the malaise the markets have been mired in this year. They want to stop worrying & start making gains again. But “no bear market ever ended due to fatigue” socionomics expert Peter Atwater cautions in our new interview with him hosted by Stephanie Pomboy. They end in fear. When no one wants to buy…

-

Social Credit Score? How About a Hard Money Credit Score!

You’ve likely heard about the idea of a social credit score, where citizens could be graded on how environmentally or socially responsible they are. You recycle? Score one. You don’t recycle, minus one. You drive an electric vehicle? Score ten. You drive a carbon-spewing SUV, minus ten. We can debate how effective something like this…

-

Gold in 2021: A Fed Pivot and Stubborn Inflation Give Hints About 2022

Our quarterly report—what we prepare for institutional investors—examines the performance of gold and silver vs. other major asset classes during the fourth quarter and full year of 2021. We also review the conditions that could ignite their prices in 2022. The big story in 2021 was the jump in inflation. And then the Fed’s announcement…