Latest News and Articles

-

Gold Market Report – May 13, 2024

Overnight: After surging from $2304 to a 3wk high at $2360 (resistance at down trendline from 4/12 $2432 ATH held) in its last 2 sessions, gold pulled back overnight. The yellow metal retreated in a range of $2365 – $2339, and fell below Friday’s $2345 low. Gold’s decline was buffered by a modest decline in…

-

How Long Will It Take the Fed to Lower the CPI to 2%? 3 Questions with Troubling Answers

Fed Chair Jerome Powell has been insistent that the central bank will lower inflation to 2%. The Consumer Price Index (CPI) is the primary way the Bureau of Labor Statistics measures the change in consumer prices, and the Fed watches this data closely to make some of their decisions. “We are resolute in our goal…

-

These Charts Show More Currency Creation is Guaranteed – and 3 Guesses How Gold Responds

It’s not very often you get to use the word ‘guarantee’ and be right about it. But this just might be one of those times. Question: what do you get when you combine a debt-based monetary system with soaring interest rates? If debt levels are rising, and the federal government has to pay interest on…

-

I Call the Fed’s Bluff: They’ll Pivot Long Before Inflation Hits 2%

It was a fight! My keynote presentation at the New Orleans Investment Conference pitted the Fed against gold, me playing both parts by using different caps when one or the other was talking. I wanted to do this because I’m continually flabbergasted by how much faith mainstream economists and investors put in what the Fed…

-

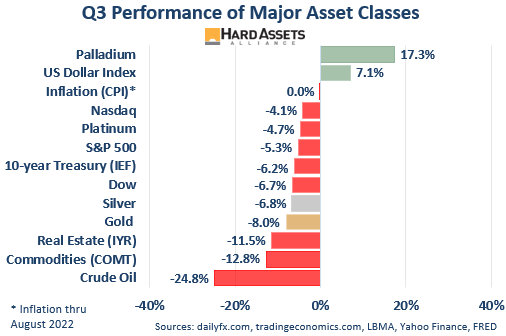

Gold in Q3: Attack of the US Dollar

Perhaps a surprise to most investors, Federal Reserve Chairman Jerome Powell made it clear last month that the central bank will be “resolute” in fighting inflation. The Fed approved a third consecutive 75-basis-point hike in September, the fifth raise this year, the most aggressive move since the 1980s. The US dollar soared in response. Those…

-

Is Our Money Dying?

As governments increase their debts & unfunded liabilities, servicing them becomes a bigger and bigger problem. That’s especially true if the pile of debt is growing much faster than the underlying economy, which has been the case for decades. This forces central banks to print more new currency in order to enable their governments to handle the debt…

![Worried About a Recession or Stock Market Crash? Here’s How Gold – and All Precious Metals – Have Historically Performed [CHARTS]](https://hardassetsalliance.com/wp-content/uploads/2022/07/image001-2.png)